Who is this guide for: Users who already have DYDX tokens in the Cosmos ecosystem and now want to stake them with Chorus One

If you wish to bridge your DYDX from Ethereum to Cosmos, check out our detailed guide here.

Step 1: Log into Keplr and connect your account

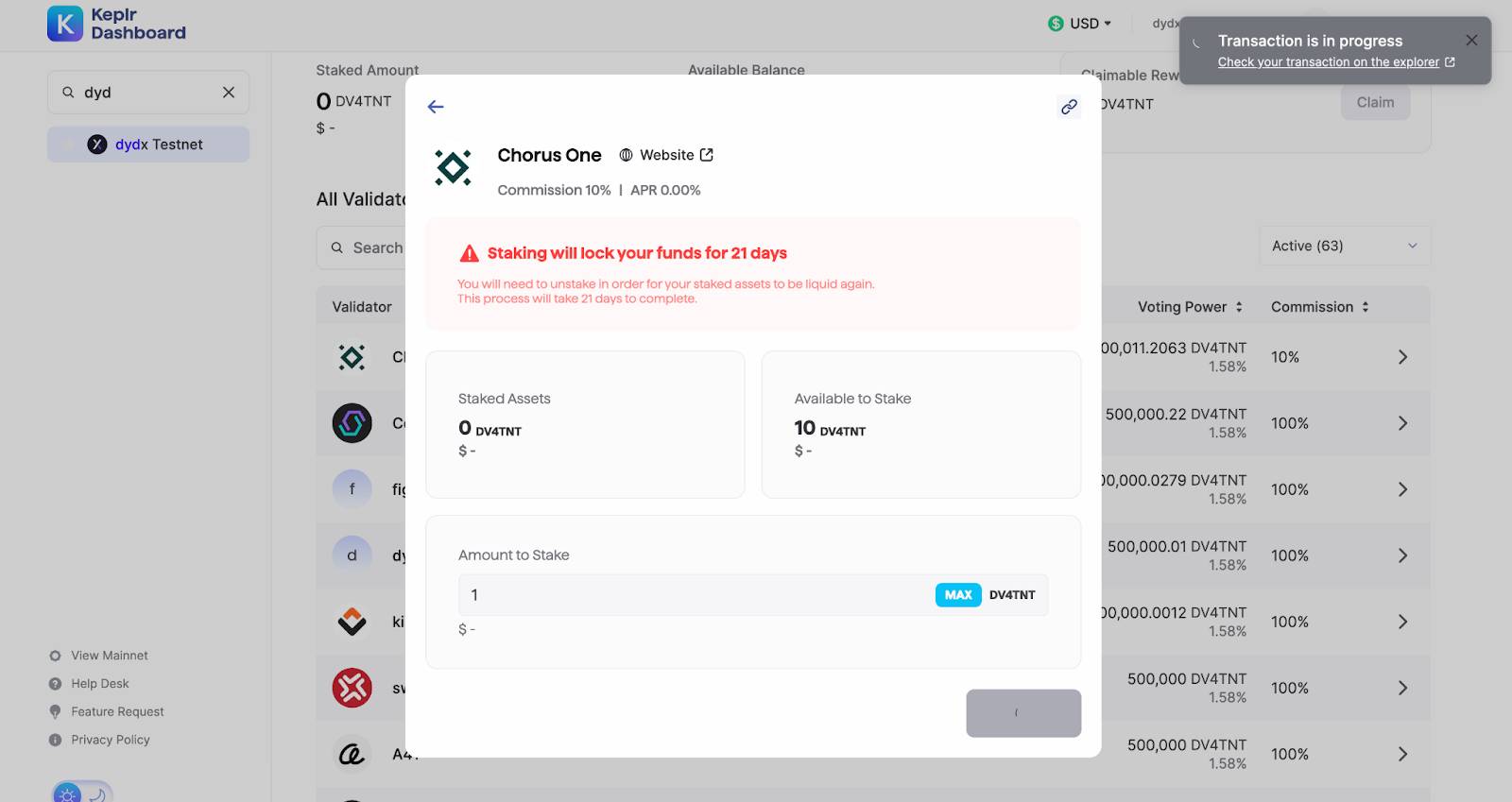

Step 2: Search for the dYdX Chain and look for the Chorus One Validator

Step 3: Click on Chorus One validator and enter the amount you would like to Stake

Step 4: Click on ‘Stake’ and follow the staking flow

Step 5: Approve Transaction. You have now staked DYDX with Chorus One!

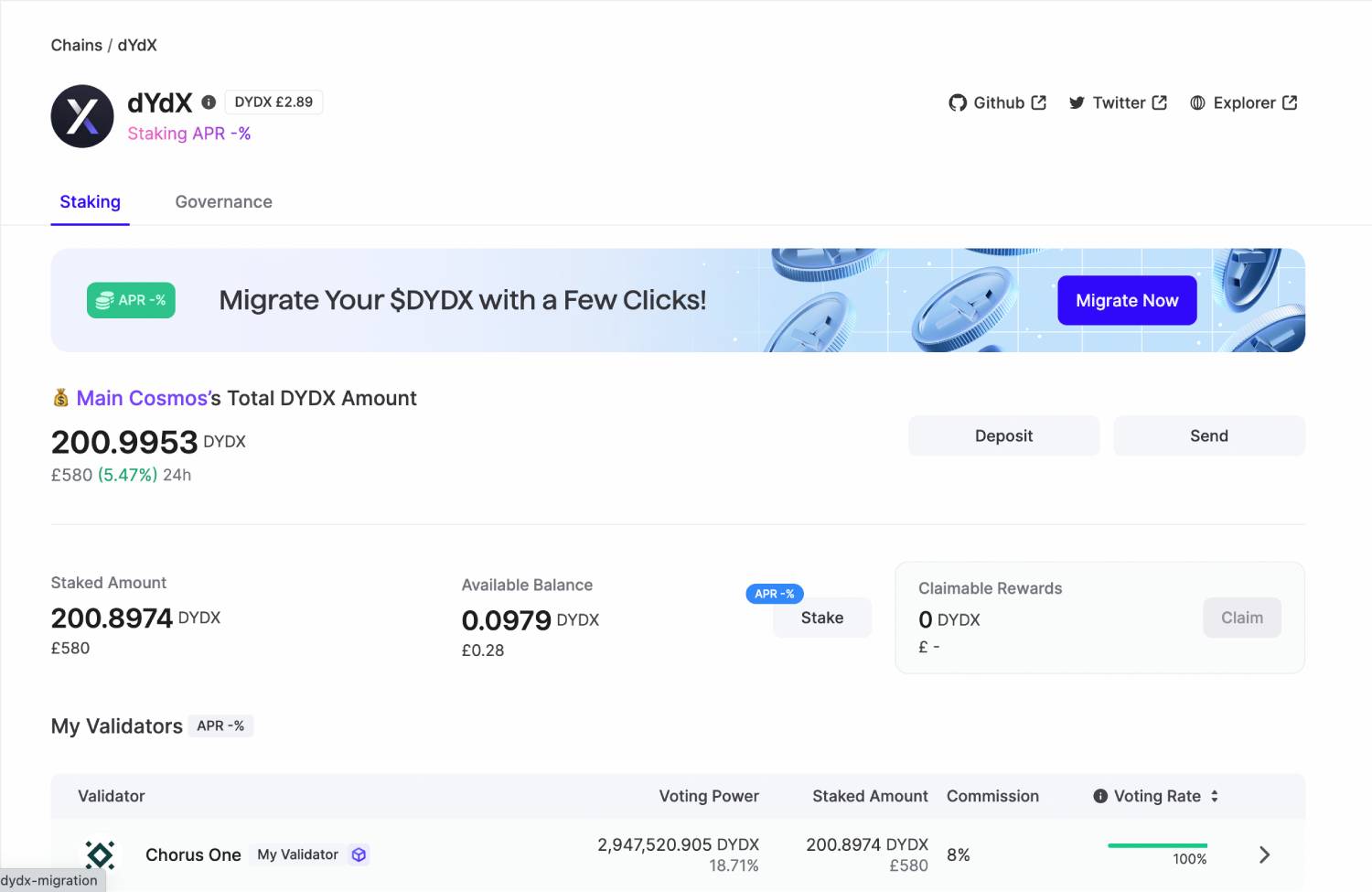

dYdX v4 is the latest iteration of dYdX, one of the most prominent decentralized exchanges and premier trading platform for cryptocurrency. The DEX initially launched as an Ethereum-based Layer 2 solution and has now made a significant move by transitioning to its dedicated blockchain, known as the dYdX Chain (or dYdX v4), built using the Cosmos SDK. We've compiled all the essential information about the chain, complete with an in-depth exploration of their move to Cosmos and Chorus One's ongoing involvement with dYdX since the very outset in a comprehensive guide. Check it out here.

There are various utilities of the dYdX v4 token, DYDX, and amongst the most popular use cases are to engage in governance proposals and participate in staking.

To use and stake DYDX, the dYdX Chain needs to onboard users from various platforms, including rollups, Ethereum L1, other app-chains, and centralized exchanges, to its Cosmos version. To simplify the process and make staking on Cosmos a breeze for our customers, we have developed a novel solution that enables you to move your DYDX tokens from Ethereum to Cosmos and stake them with Chorus One in a swift, seamless transaction. If you wish to bridge your DYDX from Ethereum to Cosmos, check out our detailed guide here.

However, if you already have DYDX in the Cosmos ecosystem, you can directly stake them with Chorus One using your Keplr wallet. Let’s proceed to how you can do this with a step-by-step walkthrough.

*Since DYDX inflation goes to traders, dYdX stakers, in contrast, will receive 100% of the trading fees that are paid out in USDC.

5. Then, click on ‘Approve transaction’.

6. You will be redirected to the staking UX, which will show that your stake transaction is processing.

7. After a few minutes, your stake transaction will be complete! You can confirm that your transaction has processes by checking the block explorer here, as shown below.

8. Once you have confirmed your transaction, you have successfully staked DYDX with Chorus One!

We’re happy to answer any questions you may have! For any support queries, please visit here. Alternatively, if you’d like to learn more about staking with Chorus One, get started with staking, or anything else, reach out to us at staking@chorus.one

About Chorus One

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 45+ Proof-of-Stake networks including Ethereum, Cosmos, Solana, Avalanche, and Near amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.

As we approach September, the eminent crypto conference of Asia, Token2049, is set to take place in sunny Singapore!

With pioneers from various crypto and blockchain domains converging on the Red Dot nation, the week promises Token2049's flagship conference on September 13th and 14th, surrounded by an array of side events (including two of our own!). The Chorus One team is brimming with excitement as we gear up to attend.

Join us at Booth M90, where a number of our team members, including Xavier Meegan, Yannick Socolov, Michael Moser, Umberto Natale, Luis Nuñez Clavijo, Hariharan Iyer, Alex Bentley, Rishi Sidhu, Chakravarthi Muppalla, and Keerthi Narendra, will be waiting to connect.

Apart from engaging in conversations about the latest in staking, make sure to swing by our booth for an assortment of fresh swag and the chance to win intriguing mystery gifts!

Kick-start your morning with us!

To participate in our breakfast side event, kindly register here.

Chorus One x Alkimiya Networking

As the vibrant introductions wind down after two days, join us at our co-hosted evening side event with Alkimiya. Register here to attend.

Lastly, what's a conference without a Chorus One twist? Following the much-loved appearance of Lefty the Alpaca at EthCC, we're conjuring yet another surprise for Token2049. Hint: Keep your eyes peeled, or you might just miss it. 🪄Lefty the Alpaca at EthCC, we're conjuring yet another surprise for Token2049. Hint: Keep your eyes peeled, or you might just miss it. 🪄

If you're attending and wish to arrange a meeting with our team, please reach out to us at info@chorus.one, and we'll get in touch. See you there!

Recent upgrades to Ethereum, such as The Merge and Shapella, were as transformative to the underlying technical algorithms of Ethereum, as they were for the underpinning economy. Previously, hardware enthusiasts and enterprises worked to provide security for the network and were generously rewarded in the process, while today the main driving force that makes Ethereum work securely is their validator community. While there are some similarities between miners and validators -- they both secure the chain via some technological process -- there are many striking differences between the two, particularly in the technology involved.

This article will focus on the technical aspects of being part of a validator community, risks associated with this role, and Chorus One’s measures to mitigate staking risks in our products.

Before 2022, Ethereum's main network used a Proof-of-Work (PoW) system called ETHash to create new blocks and handle transactions. Miners using this system had to solve complex puzzles using powerful computers to create blocks of transactions. These blocks were verified with a code unique to the miner, commonly referred to as a (ECDSA) cryptographic key. The EVM then transferred the transaction fees and additional inflation rewards into an account identified by a public key of that miner key pair. This cryptographic key pair that the miner received was known as a coinbase address, and was configured directly in software the miner used.

Now, things are different. Ethereum no longer requires complex puzzle to create blocks anymore. Instead of miners, a specific type of software called Validator Client creates new blocks. Running validators involves locking some funds on-chain, and then producing blocks when that validator is chosen as the next block producer by the randomness of the consensus algorithm. Since there is no hardware-intensive puzzle solving involved, and the randomness consensus algorithm is very lightweight and has allowed the network to reduce the hardware involved and energy spent within Ethereum blockchain. On the economic side, however, this also had profound changes.

First, they changed how rewards are distributed. Instead of the reward going to one address, it is now split into two parts: consensus and execution, which can be specified in separate accounts/addresses. It is split in this manner:

Execution rewards: fees collected for transactions in a block. These are sent to a special address set in the Ethereum software as the "fee recipient address."

Consensus Rewards: These are based on inflation and given to validators who make blocks and also to those who vote on blocks made by other validators. This consensus reward goes to an address set when a new validator is added. It can't be changed later and is called the "withdrawal address."

Second, the very algorithm used to sign the blocks was changed to involve a BLS algorithm instead of the previous ECDSA (however, the individual transaction signatures still utilize ECDSA for convenience and compatibility reasons). Next we will explain why this matters.

Now, there are two addresses involved in the reward process instead of just one cryptographic key pair. This means each validator has two key pairs. One of these key pairs is called BLS, and it's always used by the Ethereum client software to sign block information. This helps verify the address where fees should go, which is included in the block's data.

The block production process itself does not require the holder to also keep the ECDSA keys to the fee recipient address, so potentially every Ethereum address can be specified in the Validator Client to receive execution rewards. The withdrawal (ECDSA) key pair, however, is never loaded into a client, and is immutably bound to every Ethereum validator during the validator creating process.

For validators, this means that there exists a non-custodial process which allows them to lock their Ethereum coins in the blockchain while still having control over those funds and any future consensus rewards, while the actual Validator Clients can be run by a separate entity. Such an entity would only hold validator BLS signing keys and not the withdrawal ECDSA keys.

The Validator BLS key pair, which is important for confirming and creating new blocks, is traditionally generated from random information using a secure method that keeps the private keys unpredictable. Chorus One has its own in-house tool that makes generating keys fast and secure, which you can read more about here.

After creating the keys, the on-chain verification and loading of the deposit transaction data both kick off in parallel, in a process known as ‘Voting period’, and usually takes around 16 hours. During this time, Ethereum nodes from across the globe will read the deposit transaction log, and vote on whether the signature included in the transaction is correct. When enough votes for correctness are collected, the voting period elapses. However, the validator does not immediately start to fulfill its duty of securing the chain, but due to a limitation in the amount of validators that can become active per block, some additional time is spent in an activation queue. More information on this process can be found here.

Once the activation queue period has passed, the validator clients where the keys have been loaded will start fulfilling Ethereum blockchain duties. Only after this point is that specific duties can be assigned and the keys will start being used to produce signatures and blocks.

This process is visualized on the following image:

The biggest danger for validator key holders is if those keys are stolen, because attacker in possession of the victim validator keys can produce messages infringing to security of a blockchain, which will lead to slashing the validator that incurs a large penalty (more than 1Eth per validator).Currently, it is not possible for a perpetrator in this scenario to profit from such operation, however the possibility to vandalize the ledger still exists and is the most significant risk when operating the validator keys. Thus, participation in staking usually involves consistent and well-thought security practices that prevent unauthorized access to the validator key seed. It is also important to understand that a single seed can be used to generate multiple validators; the more validators were created from a single seed, the bigger the potential impact from leaking the keys.

Besides this, other risks arise from the operation of running validators.

Client software risks

The Ethereum community often discusses the risks associated with client software diversity, which refers to having different types of software implementations. Ethereum offers various open-source validator options, and users can even create their own software. However, most users prefer established open-source options. Validator software is complex and can have bugs that lead to penalties. To minimize risk, stakers should use different validator software types to avoid simultaneous problems that could result in increased penalties for everyone, known as an "inactivity leak."

It's better for stakers to run multiple types of validators to reduce risk. Currently, Ethereum has good diversity at the consensus layer, but there's an issue with one software type dominating the execution layer. Bugs often appear in specific software versions, but Ethereum runs multiple versions simultaneously to reduce risks. Those using a service to stake Ethereum should make sure the service uses diverse software types for both main agreement and action parts of Ethereum.

Withdrawal risks

Withdrawal risks arise from possible issues with the withdrawal keys, like if they are accidentally revealed or if access to the wallet's private key (ECDSA) is lost. As of now, Ethereum lacks mechanisms to regain access to validator withdrawal once the wallet is lost. This underscores the significance of using a trustworthy wallet, maintaining backups, or relying on a reputable custody provider to safeguard the withdrawal seed. It's essential to ensure the correct wallet public key is used when setting up the validator.

At Chorus One, we operate over 8000 validators on the Ethereum Mainnet for various customers, drawing from years of experience without encountering any slashable offense. In the following sections, we'll delve into the techniques we've developed to oversee validator operations, along with the software and infrastructure controls we've implemented. These measures are aimed at minimizing risks for our customers.

Validator key security is at heart of our operation. We ensure that validator keys are never stored on disk without encryption. We utilize cloud-based Vault software, implementing zero-trust access controls, to securely store and provide validator keys to validator clients throughout their lifecycle and operation.

We employ Vault access control policies to ensure that only software clients have access to validator key content. We also segment access for different processes, ensuring that each validator client process can access only a specific set of keys. These keys are guaranteed to be unique across all processes. While generating each validator's private BLS key, we use a strong source of randomness to minimize the possibility of collisions. Furthermore, an SQL database with a unique constraint on the validator's public key field is used to ensure that generated validator keys are never reused for new validators, even if a validator is exited later.

To maintain transparency, we maintain an append-only log of all operations on the Vault storage, and we routinely review it for any anomalies. When it comes to data transfers involving validator keys, they exclusively occur through TLS encrypted channels. Additionally, backups of validator key storage are encrypted with multiple keys, requiring the authorization of multiple individuals to restore from the backup. Each mnemonic used for a validator's BLS private key is unique and exclusively assigned to that specific validator. This approach further minimizes the risk of key leakage.

For each validator client, we maintain a local slashing protection database. Additionally, we utilize the Web3Signer signing service, which employs a centralized slashing protection database. This dual-layer approach offers enhanced security. In the event of potential glitches or bugs in our cloud platform that might result in two instances of the same process running with the same local slashing protection database, the centralized Web3Signer database acts as a safeguard against double signing by our validators.

The Web3Signer centralized database is replicated across multiple data centers, ensuring redundancy and availability. An automated fail-over mechanism is also in place to address any downtime in a data center. The protective measures employed by Web3Signer to prevent double signing are depicted in the illustration below.

At the core of our infrastructure lies a network of public Ethereum nodes that actively engage in the Ethereum consensus and execution process. These nodes establish dependable infrastructure pathways that support the seamless functioning of the Ethereum network. These public nodes are strategically positioned across various geographical data centers, ensuring redundancy and reliability.

Within our validator clients, we've implemented load-balancing mechanisms. This ensures that if one of the data centers experiences an outage, our validator clients seamlessly transition to utilizing Ethereum nodes from other operational data centers.

Alongside the usual health checks for Ethereum APIs, our load-balancing strategy incorporates personalized health assessments for Ethereum nodes. For instance, if an Ethereum node's connected peers experience a sudden drop, our load balancer redirects validator traffic away from that node. This action prevents any potential issues with attestation or block propagation.

At Chorus One, we adopt a safeguard by running various implementations for both the consensus and execution layers in parallel. This approach ensures that any bugs in a single client implementation won't impact all of our nodes. The visual depiction of the infrastructure alignment between public nodes and validators is illustrated in the diagram below.

Our validator client software connects to the public Ethereum nodes, which are hosted on lightweight cloud appliances situated in proximity to the public node hosts. We maintain distinct validator client processes for different customers, ensuring that validators from separate customers don't share the same process memory.

We employ cloud automation software to facilitate automated upgrades for the client process. This includes an instant rollback feature triggered by automated health checks if any misconfiguration is detected that could potentially result in penalties.

Our infrastructure platform, Kubernetes, operates on top of public cloud providers, ensuring that only a single instance of each validator client process is active at any given time. This is achieved through the utilization of StatefulSet resources, which terminate old processes before launching new ones during restarts.

Our automated validator client updates undergo thorough testing before implementation. Updates are applied exclusively to Ethereum mainnet validators that have been rigorously evaluated and proven effective in privatenet and public testnet environments prior to deployment. The process of automated upgrades and rollbacks is visually depicted in the diagram below.

The controls and mechanisms mentioned above are sophisticated and prioritize security and safety over maintaining uptime. For instance, our validator client software integrates slashing protection to prevent signing attestation in scenarios where true double signing could occur, or if there's an issue with the centralized slashing protection database service.

Another example pertains to the potential downtime of the Vault service, which could lead to validator clients being unable to load signing keys and thus unable to sign on time. To address this, we implement continuous monitoring for all validators and the underlying infrastructure, generating automated alerts if any issues arise. To ensure comprehensive oversight, even in cases where our internal monitoring might falter, we employ a separate process of on-chain monitoring. This process involves scraping Ethereum blockchain APIs from an isolated set of public Ethereum nodes. It raises alerts if any penalties are detected with Ethereum validators.

Our team of rotating on-call engineers is available round the clock to respond to these alerts promptly and troubleshoot any potential problems with validator clients.

About Chorus One

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 40+ Proof-of-Stake networks including Ethereum, Cosmos, Solana, Avalanche, and Near amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.

We take a look at expected times to participate in Ethereum staking.

Ethereum protocol times are measured in epochs, with 1 epoch being 384 seconds or around 6 and a half minutes. For ease of understanding, times based on these measurements have been translated roughly into minutes, hours and days.

88,885 / 25

Source: https://beaconcha.in/

Conclusion: Staking takes at least 8 hours, but it is very likely to take a lot longer as the demand to stake grows and more validators are added to the queue (the queue at the time of writing is 88,885 validators waiting). The waiting time right now is about a month and a half.

88,885 / 25

Source: https://beaconcha.in/

Conclusion: Unstaking takes at least 25 minutes, but can vary depending on the withdrawal queue with a similar model as staking (the queue right now is 25 validators waiting and is expected to clear quite quickly). You also have a 1 day delay to access funds. So, all in all the waiting time right now is about 1 day.

* This number corresponds to the churn rate applied to the staking and withdrawal queues. For every 65,536 additional validators that are active on the Ethereum network, the number of new validators that can be activated per epoch increases by one, and the number of validator exits that can be processed per epoch also increases by one. Right now, the churn rate is 9.

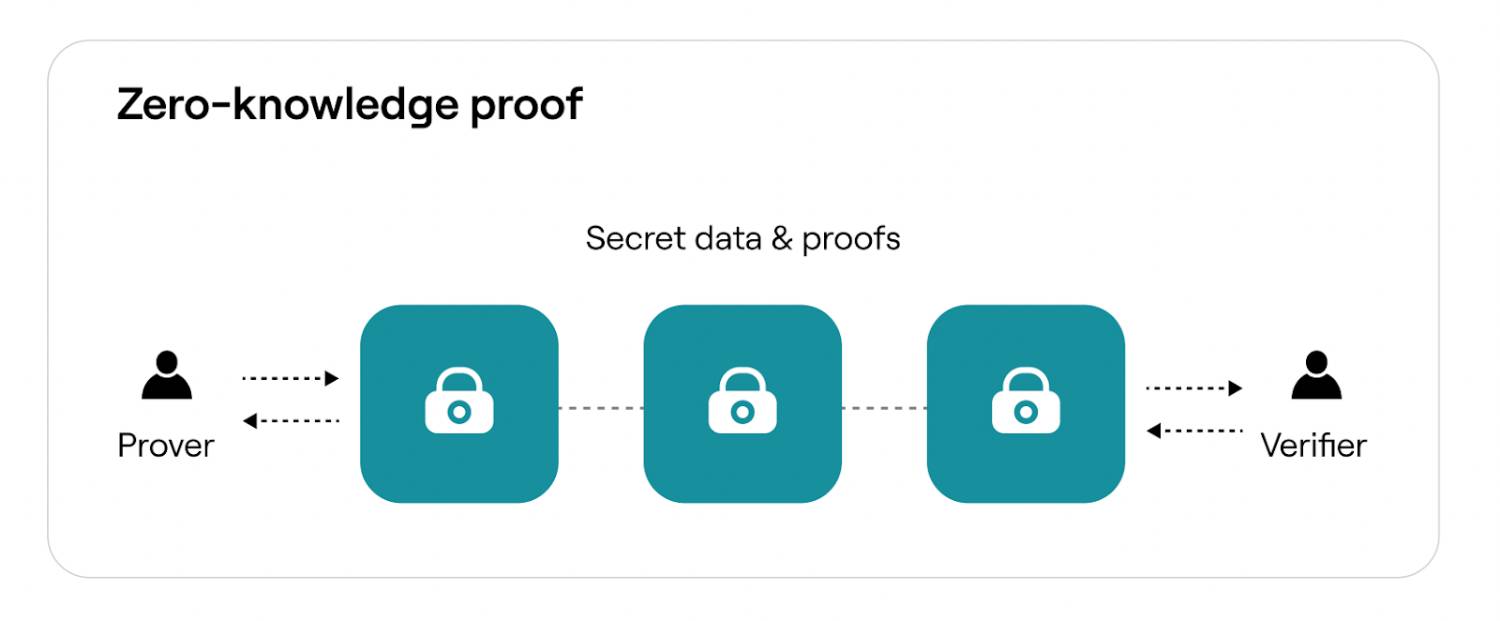

Blockchain has revolutionized various industries by offering decentralized, secure, and transparent systems. However, challenges such as privacy and scalability have emerged as significant concerns. This article explores how Zero-Knowledge Proofs (ZKPs) can address these challenges and shape the future of Web3 technology.

What are zk-Proofs?

Zero-Knowledge Proofs are cryptographic protocols that allow a party to prove knowledge of a certain fact without revealing any information about it. In other words, they enable verification of the truthfulness of a statement without disclosing the underlying data. ZKPs were introduced by Shafi Goldwasser, Silvio Micali, and Charles Rackoff in the 1980s. However, it wasn’t until the development of the ZK-SNARK protocol in 2014 by a team of researchers led by Eli Ben-Sasson, that ZKPs gained significant attention for their potential applications in various fields, including the crypto space.

There are different types of Zero-Knowledge Proofs, each serving specific purposes:

Enhancing Privacy and Scalability

Zk- proofs have a profound impact on privacy. By using ZKPs, users can prove the validity of their transactions or data without revealing the sender, recipient, or the transaction amount. This feature enhances anonymity and confidentiality, making blockchain systems more appealing for applications where privacy is crucial, such as financial transactions, healthcare records, identity management, and secure voting systems..

ZKPs also enable scalability improvements by reducing the amount of data that needs to be processed and stored by blockchain nodes. This is achieved through a process called ‘batching’, where multiple transactions are combined into a single proof, reducing the computational load on the network. For example, ZKSync Era, a trustless Layer-2 protocol, is a zk rollup that scales Ethereum by using cryptographic validity proofs to provide scalable and low-cost transactions. In zkSync, computation is performed off-chain and most data is stored off-chain as well. However, all the transactions are still verified and validated on the Ethereum mainchain, ensuring that users have the same level of security as they would with regular Ethereum transactions.

The Challenges

Despite their potential, zk-Proofs face several challenges:

The Future Outlook of ZKPs

Looking ahead, we can expect advancements in zk technology that address the current challenges Some potential developments include:

ZKP’s offer a promising solution to the privacy and scalability challenges faced by current Web3 technologies. By enabling secure, private transactions, they pave the way for a future where decentralized applications can thrive while protecting user data. While challenges exist, ongoing research continues to enhance the efficiency, scalability, and usability of ZK technology, shaping the future of blockchain and its potential impact on other industries.

Our 2023 Q1 Quarterly Insights dives deeper into the different applications of zk-Proofs, presenting an introduction to the problems being tackled in the frontier. It also focuses on specific use cases, shedding light on notable teams building innovative projects that take advantage of zero-knowledge. Check it out here.

About Chorus One

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 40+ Proof-of-Stake networks including Ethereum, Cosmos, Solana, Avalanche, and Near amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.

The first half of 2023 has been marked by a flurry of captivating events in the crypto sphere, and we have only just begun to scratch the surface of what lies ahead for the remainder of the year. Rest assured, as The Spotlight curates the finest selection of staking news each month.

But that's not all. In May, we were highly productive, engaging in exciting projects and concocting a wealth of crypto knowledge. This newsletter serves as your exclusive invitation to delve into the plethora of developments we pursued last month, ensuring you remain well-informed and up-to-date. Moreover, as believers in a global crypto community, we're always on the move. So, find out where our team will be in June below!

1. Ledger by Chorus One: Securely stake your tokens via the Ledger Live App

With Ledger’s extended compatibility with the Cosmos ecosystem, over 1.5 million Ledger Live users can now stake numerous tokens including Onomy, Quicksilver, Persistence, and more through nodes operated by Chorus One. Read all about it here.

2. Lido upgrades to V2 mainnet

After a successful governance vote, liquid staking protocol Lido upgraded to its second version, enabling users to unstake their stETH and receive ETH at a 1:1 ratio. We’ve captured everything you need to know about why this is significant here.

3. The number of staked ETH hit its all time high since Shapella

The amount of staked ETH continued to grow since the advent of Shapella upgrade, having surged by a mighty 4.4M since withdrawals were enabled. We’ve explained why this trend is likely to continue here.

4. $700m staked ETH shifts away from centralised exchanges

Regulatory concerns and the allure of higher rewards prompt investors to flock to decentralised liquid staking protocols, leaving traditional exchanges in the dust. Read all about it here.

OPUS

We’re proud to announce that our multi-chain staking solution, OPUS, is now live and running! OPUS allows our customers to stake with utmost ease, and earn maximum rewards while having complete control over their nodes. OPUS also comes with a range of features that optimise the staking experience for our customers. Read all about it here.

Ledger by Chorus One

We’re delighted to be partnering with Ledger Live to support their extended compatibility with the bolstering Cosmos ecosystem. This partnership permits a larger number of crypto investors to stake Cosmos tokens on the Ledger Live App through nodes operated by Chorus One. More on this here.

Recently, our Chief Commercial Officer, Felix Lustch, was joined by Ledger’s Global Head of Client Success Lila Garcia and Anchorage Digital’s Head of Product, Boaz Avital to explore future trends in the staking frontier. They had an insightful discussion, covering topics including the latest advancements in staking infrastructure, regulatory movements, and risk management in crypto. If you missed it, feel free to watch the recording here.

Stake SUI with Chorus One

SUI Network is the latest network to join the ranks of networks supported by Chorus One. After three testnet waves, Sui launched their Mainnet this month, and we're proud to support the growth of the network as one of the genesis validators. Our blog delves into the unique characteristics of the Sui network and explains how you can start staking SUI with Chorus One. Read it here.

Gelato x Chorus One

Chorus One has partnered with Gelato Network as one of the genesis node operators for GEL staking! We participated in a number of discussions exploring this partnership and the future of GEL staking, which you can hear here.

Fordefi x Chorus One

We’re proud to announce our partnership with Fordefi, a leading MPC wallet platform and web3 gateway, facilitating Chorus One’s customers to stake and unstake multiple tokens using the Fordefi wallet inside OPUS. Full details here.

1. Quarterly Insights

Our research team produces an in-depth analysis of the industry's biggest trends every quarter. We published the first edition of 2023’s quarterly insights, which covers:

Read the full report here.

2. Beyond Shapella

Ever since the Shapella upgrade, the influx of institutional interest in ETH staking has been remarkable. Our blog delves into the reasons behind this trend and why we expect this trajectory to continue. Read it here.

3. A guide to Lido V2

Lido upgraded to its V2 Mainnet - making stETH withdrawals possible for its users, and paving way for a more decentralised future to the Ethereum network. We covered everything you need to know about this upgrade, and why it’s so significant. Read it here.

4. Key takeaways - the evolution of Shared Security

Shared Security is a method aimed at enhancing the safety of a blockchain by leveraging resources from other blockchains. Several PoS networks adopt shared security as a strategy to fortify their blockchain's security while introducing new use cases. Our article provides a clear overview of how shared security has evolved and offers concise explanations of its implementation across various PoS networks. Read it here.

June 1-2 | Crypto Valley Conference | Rotkreuz, CH

The Chorus One team will be attending the Crypto Valley Conference on June 1-2, in Rotkreuz, CH. If you’re attending, look out for one of our team members including Meher Roy, Tomas Matta, Rakesh Bhagloe, Neal Roche, or Michael Moser to discuss what we’re currently working on, or to address any questions you may have about staking.

Also, if you’re attending, don’t miss out on the tax roundtable that Rakesh Bhagloe from our Finance team will be participating in alongside industry professionals from KPMG, MME, and Safe to discuss how VAT is treated in DLT transactions.

To register, visit: cryptovalleyconference.com

June 3-5 | Gateway Conference 2023 | Prague, CR

Join our Partnership Manager, Yannick Socolov, as he shares his insights on the secrets of building thriving and enduring Web3 communities at 3.30pm on June 5th.

To register, visit: https://gateway.events

About Chorus One

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 40+ Proof-of-Stake networks including Ethereum, Cosmos, Solana, Avalanche, and Near amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.