Bitcoin's Layer 1, revered for its unparalleled security and decentralization, has faced scrutiny over its scalability, cost, and throughput limitations. These constraints catalyzed the emergence of alternative networks like Ethereum, designed with smart contracting capabilities at their core. However, the narrative is shifting. With the introduction of Layer 2 solutions that integrate DeFi functionalities to Bitcoin, it’s poised to expand its utility far beyond a store of value.

In this article, we delve into the intricacies of Bitcoin Layers, and explore some of the projects in the space we’re most excited about.

As a team that is continually researching new technologies and exploring promising narratives, we’re thrilled to expand our expertise in the Bitcoin economy and collaborate with key players building in this ecosystem.

The Bitcoin Problem

Before delving into the nuances of Bitcoin Layer 2 solutions, let's take a step back and understand the core concept of Layer 2s. A Layer 2 is built on top of the base chain (Layer 1) to improve scalability and transaction throughput.

Bitcoin and Ethereum are Layer 1 protocols, serving as the settlement layer for all transactions on their respective networks. Layer 2 solutions offer a way to increase transaction speeds and scale the network while benefiting from the security of the main chain.

While numerous Layer 2 solutions, such as rollups, side chains, and channels, are already building on Ethereum, and Bitcoin Layer 2s have been in development for some time, several projects are now closer to launching and expanding Bitcoin's utility. However, scaling Bitcoin presents unique intricacies that need to be addressed.

The most crucial requirement for a Bitcoin Layer 2 solution lies in deriving its security from Bitcoin's own security model, a task that proves challenging in practice. To effectively secure a Layer 2, Bitcoin must possess the computational capability to validate the behavior of the Layer 2. However, Bitcoin's current computational capacity falls short compared to Ethereum's Layer 2 solutions.

For instance, Ethereum rollups derive their security from the Layer 1 by either verifying a zero-knowledge proof (zk-rollup) or confirming a fraud proof (optimistic rollup). Nevertheless, there are ongoing proposals aimed at enhancing Bitcoin's functionality to enable the base layer to validate zk-Proofs submitted by rollups. Additionally, initiatives like BitVM strive to implement fraud proofs without necessitating alterations to the base layer.

While solutions are emerging to address this challenge, they bring their own set of architectural choices and leverage novel technologies to find viable solutions. As the development of Bitcoin Layer 2s progresses, the ecosystem will need to carefully evaluate the trade-offs and implications of each approach.

Bitcoin's Layer 2 solutions face unique challenges in trying to improve upon the base layer. These challenges revolve around three main goals: handling more transactions, maintaining robust security, and ensuring that the system remains decentralized. Here's a simpler look at each goal:

By focusing on these three areas, Bitcoin's Layer 2 aims to enhance the base layer's capabilities while adhering to the principles of scalability, security, and decentralization. This approach ensures that the network can grow and adapt to new demands without compromising on its core values.

In this section, we explore a few Bitcoin L2s that we’re excited about, and provide a quick overview of the project.

Overview: Stacks brings smart contracts and decentralized apps to Bitcoin using a unique Proof-of-Transfer (PoX) mechanism. Key Features:

Overview: Designed for fast and cost-effective micropayments on Bitcoin.

Key Features:

Overview: Introduces Ethereum-compatible smart contracts to Bitcoin.

Key Features:

Overview: Builds on BTC to EVM bridging technologies, offering a novel dual-token staking model via $HODL.

Key Features:

Overview: The first implementation using BitVM, focusing on scalable and efficient transaction processing.

Key Features:

Overview: Merges Proof-of-Stake with Bitcoin’s robustness, focusing on cross-chain functionalities to offer Bitcoin restaking.

Key Features:

Overview: Offers private and scalable off-chain Bitcoin payments.

Key Features:

Overview: Implements a zk-rollup model to improve transaction efficiency and security on Bitcoin.

Key Features:

Overview: An Ethereum-based Proof-of-Stake Layer 2 that uses Bitcoin as its core asset for staking and governance.

Key Features:

Overview: A zk-rollup solution that stores proofs and transaction data directly on Bitcoin's blockchain.

Key Features:

Overview: BOB is an Ethereum-based Layer 2 solution designed to integrate closely with Bitcoin, maintaining alignment with Bitcoin's principles.

Key Features:

Overview: Twilight offers a platform for deploying privacy-focused decentralized exchanges and other applications, using advanced cryptographic methods to ensure security and privacy.

Key Features:

…and more! Stay tuned for Part 2, where we'll delve into even more exciting projects emerging within the ecosystem.

As a forward-thinking infrastructure provider, Chorus One is thrilled about the immense potential of integrating DeFi functionalities into Bitcoin and witnessing its evolution beyond being a store of value. Engaging in in-depth research into promising new technologies and projects, we're excited to explore a new landscape beyond Proof of Stake-based networks.

We're actively collaborating with L2s to delve deeper into the ecosystem. If you're interested in learning more or getting involved with some of the projects we're working with, please reach out to us at staking@chorus.one. We'd be delighted to connect with you.

In blockchains that utilize Proof of Stake, staking allows users to receive rewards by locking tokens to aid in validating transactions and securing the network. Staking services lower barriers to entry by handling technical complexity. Users can stake any tokens without the need to run validators.

At Chorus One, we are happy to announce that we will provide Staking-as-a-Service (SaaS) solution to users at the Lava mainnet launch. Lava network is a protocol that serves as a gateway for applications to access trustworthy, secure, and swift RPC services. Unlike conventional methods that hinge on centralized or public RPC endpoints, Lava Network leverages a decentralized array of premier service providers.

At the cutting edge of blockchain accessibility, Lava provides a user-friendly and scalable solution to tackle the crucial requirement for an Access layer in the blockchain infrastructure. The network makes it very easy for blockchains and rollups to bootstrap a set of infrastructure providers, so users and developers can onboard smoothly.

Lava is an application-specific marketplace for decentralized blockchain Remote Procedure Calls (RPC) and APIs based on CosmosSDK. Lava is designed to enhance access scalability to various blockchains. This network has the ability to accommodate any RPC and API in a flexible manner,. Lava boasts of a lightning-fast network that is hyper-scalable, and permissionless with nearly 100% uptime.

A Remote Procedure Call, or RPC, is a lightweight software communication protocol, that allows for developers to run code that can be executed on servers remotely.

On Lava, blockchain and rollup developers can quickly bootstrap a network of infrastructure providers, without waiting for major providers to add support. The protocol's initial focus is directed towards RPC infrastructure, a service that aids developers to access over 30 diverse chains, from EVM to Cosmos.

In this section, we break down the different architectural elements of the Lava Network:

Specs - Specs, otherwise called Specifications, are the foundational blueprints for Lava's multichain support, outlined in JSON format. These specifications delineate the minimum requirements necessary for an API to function on Lava effectively. Through these specs, Lava identifies the supported chains and methods while also setting up the associated costs, prerequisites, and validations. Each time the ecosystem requires a fresh API, a new specification is seamlessly integrated. This flexible method seamlessly weaves modularity into the protocol, guaranteeing that Lava stays up-to-date and flexible.

Peer-to-Peer Lava SDK - The Lava SDK is a decentralized, peer-to-peer blockchain RPC for developers who are exploring the cross-chain functionality the ecosystem is offering. It offers a simplified setup for multi-chain RPC, where adding a new chain can be done with a few lines of code. The Lava-SDK is a JavaScript/TypeScript library that was built to provide decentralized access to all chains supported by the Lava ecosystem. It further provides necessary tools for server and online environments, simplifying the process of building decentralized applications and interacting with multiple blockchains.

Gateway - Lava Gateway is a user-friendly web platform for developers that provides instant access to blockchain data. The Gateway makes use of the Lava Server Kit to offer a hosted entry point for developers seeking RPC via the Lava Network. This setup enables users to handle and set up Web3 APIs using user-friendly controls right from their browser. While the Lava Server Kit and SDK offer enhanced control and permissionless features, the Lava Gateway grants similar entry to our base network along with extra conveniences like project management utilities and user accounts.

The Lava mainnet is scheduled to launch soon while the team focuses on delivering an easy, fast multi-chain experience. The team published their Tokenomics today, which is available here.

Token details for LAVA stakers:

• LAVA is used to reward infrastructure providers on Lava

• Providers can earn native tokens from chains/rollups supported by the network

• LAVA can be restaked to earn additional yield and lower security fees

• LAVA has a capped supply with deflationary mechanisms

Lava Network is a modular network that focuses on giving blockchains and rollups a performant and reliable access layer. RPC is the first supported use-case, but other services related to data access will be added soon e.g. indexing.

To read more about Lava Network, we recommend the official documentation available in docs.lavanet.xyz.

We currently support infrastructure for over 50 networks, and we're thrilled to announce that Chorus One will be providing staking services to users as the Lava team heads towards the mainnet.

Chorus One Ventures is an early investor in LAVA, and has been supporting the project since its inception. Chorus One’s impeccable reputation, along with its thorough risk management protocols and collaborations with insurance providers, highlights the priority placed on safeguarding, ensuring the security of your LAVA staking activities remains untarnished.

For any other questions or to stake LAVA with Chorus One, reach out to staking@chorus.one

Chorus One is one of the biggest institutional staking providers globally, operating infrastructure for 50+ Proof-of-Stake networks, including Ethereum, Cosmos, Solana, Avalanche, and Near, amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures. We are a team of over 50 passionate individuals spread throughout the globe who believe in the transformative power of blockchain technology.

Chorus One is proud to be a validator on Berachain, a high-performance modular EVM compatible blockchain powered by Proof-of-Liquidity. In this article, we provide an overview of everything you need to know about Berachain, how it works and use cases.

Berachain, currently in Testnet phase, is changing how DeFi users access liquidity, supercharging applications, and providing flexibility and adaptability to the thriving digital economy. It combines the capabilities of the Cosmos SDK and introduces its novel 'Proof of Liquidity' as well as their new modular implementation of the EVM called Polaris. This not only tackles current obstacles but also paves the way for fresh avenues of creativity and advancement within the DeFi industry.

Berachain is a DeFi-focused Layer 1 blockchain running on Proof of Liquidity consensus built on the Cosmos SDK. Berachain emphasizes modularity in its design approach. By incorporating Polaris, Berachain not only ensures EVM compatibility but also supports a modular framework that allows for easy separation of the EVM runtime layer and crafting stateful precompiles and unique modules enabling the creation of smarter and more effective contracts.

Berachain operates a tri-token system: BERA (native token of Berachain i.e gas), HONEY (stablecoin) and BGT (governance token). Berachain Blockchain also provides a user-friendly interface and a comprehensive array of tools for developers and builders to create and deploy their applications.

Proof of Liquidity is a concept introduced by the Berachain team that enables users to stake various tokens and delegate this stake to validators. Users can stake assets like BTC, ETH, L1 tokens wBTC, wAVAX, wETH, wADA, and stablecoins.

Proof of liquidity models seeks to address challenges in common decentralized systems like liquidity fragmentation and stake centralization. Though Proof of Liquidity builds on the concept of proof of stake, the token used for staking is no longer the same token used for many on-chain actions. Moreover, the sole way to acquire new governance tokens (BGT) is through providing liquidity into DeFi applications.

Image source: Berachain Documentation

The concept behind PoL implies that users stake different tokens to enhance the chain's liquidity and bolster the Layer 1 security at the same time. This setup enables users to earn fees by contributing liquidity through staking while also receiving block rewards. Moreover, users have the option to mint HONEY by providing assets as collateral and utilize them within the Berachain ecosystem without constraints.

Berachain's EVM compatibility is derived from the Berachain Polaris EVM library, which enhances the EVM experience compared to the traditional Ethereum setup. Polaris Ethereum not only provides the standard Ethereum features but also empowers developers with the ability to design stateful precompiles and custom modules for crafting smarter and more robust contracts.

Polaris can be easily integrated into any consensus engine or application, including Cosmos-SDK. This modular approach streamlines the EVM integration process and reduces the time and overhead cost for developers to implement their own EVM features.

For DeFi Users - Berachain BEX

BEX is Berachain’s decentralized exchange that allows users to add liquidity to an asset pool and receive trading fees and incentives.

BEX introduces the concept of House pools, which serve as the backbone of the exchange. These default pools hold significant importance as they generate BGT rewards, which could be staked later with validators to participate in governance.

BEX also introduces Metapools, a liquidity pool where LP tokens can then be used as part of an asset pair in another pool, helping to increase capital efficiency across the chain.

Berachain Bends allow users earn interest and rewards by supplying assets like (ETH, BTC, and USDC) and borrowing HONEY. On Bend users can deposit collaterals to contribute to the platform liquidity, earn BGT rewards by utilising and borrowing HONEY within the ecosystem.

Berps

Berps by Berachain (Perpetual Futures Contract Trading) provides users with endless trading opportunities with a wide array of asset access EVM and Cosmos. It is liquidity efficient, robust and easy to use.

Chorus One will be providing staking services and contributing extensive knowledge in infrastructure development to the network. Our role as validators in the Berachain community symbolizes a collaborative effort aimed at delving into new horizons and enhancing the potential within this ecosystem.

Users providing liquidity in the BEX liquidity pools will gradually accumulate BGT, and can be used to create and vote on governance proposals such as proposals that decide on which LP pools receive BGT emissions. BGT can also be burned 1:1 for BERA. This is a one-way function, BERA cannot be converted into BGT.

Reach out to staking@chorus.one to get started or to learn more.

To read more about Berachain, we recommend the official documentation available in docs.berachain.com.

Chorus One is one of the biggest institutional staking providers globally, operating infrastructure for 50+ Proof-of-Stake networks, including Ethereum, Cosmos, Solana, Avalanche, and Near, amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures. We are a team of over 50 passionate individuals spread throughout the globe who believe in the transformative power of blockchain technology.

Imagine a world where online interactions don't come at the cost of your privacy. Where you can participate, transact, and share data on your own terms, shrouded in a cloak of cryptography. This is the future envisioned by Aleo, a revolutionary blockchain project that throws open the doors to a privacy-centric internet. Let's delve into Aleo, exploring its technology, participants, and the diverse ecosystem it cultivates.

At its core, Aleo is a layer-1 blockchain that leverages zero-knowledge proofs (ZKPs) to unlock unprecedented possibilities for private applications. ZKPs allow users to prove the legitimacy of information without revealing the underlying data itself. This translates to applications where users can participate, interact, and share data confidently, with their privacy remaining more sacred.

Credit: A credit is the native asset of the network. It is used to pay for deployment and execution fees of zero-knowledge programs. Credits can also be staked on the network as a form of governance to protect the integrity and security of the protocol.

Microcredit: A microcredit is a subdivision of the native asset (credit). One credit can be further divided into smaller units, and a microcredit is one millionth of a credit.

Prover: A prover is a node on the network that computes zero-knowledge proofs. These proofs, which can be of two types (solutions and transactions), are crucial for validating and securing transactions and activities on the network.

Solutions: In the context of zero-knowledge proofs, a solution attests to the execution of a randomly-sampled Aleo program. When a prover successfully proves the execution, a reward is distributed to both the prover and the stakers on the network.

Transactions: Transactions attest to the execution of user-deployed Aleo programs. When a prover provides a valid transaction proof, a transaction fee is rewarded and distributed to the network.

Stakers: These individuals contribute to the network's security by locking up their Aleo credits (ALEO), earning rewards in return.

Validators: Similar to traditional blockchains, validators verify transactions and secure the network, ensuring its integrity and preventing fraud.

The robust architecture of Aleo rests on three key pillars:

AleoBFT is a DAG-based BFT protocol inspired by Narwhal and Bullshark. Validators propose batches of transmissions, await 2ƒ + 1 signatures, certify the batch, and advance rounds synchronously for an honest majority. In odd rounds, validators elect a leader for the previous even round, ensuring availability thresholds are met. This process ensures all validators advance together, assuming honesty.

Here’s how the Quorum for Block Production in Even Rounds is achieved:

The native token of the Aleo ecosystem, Aleo credits (ALEO), serve multiple purposes:

How Aleo Credits are distributed:

AleoBFT operates over a simple set of data structures - a committee, batch proposal, and block. Let’s understand these one-by-one:

Committee:

Batch Proposal: In each round, every committee member suggests a batch to certify, using batch proposals to communicate and maintain agreement on the DAG's status. Each batch proposal contains a Batch ID, Batch Header and a Batch Certificate.

Block: A block is created when the commit rule is activated in AleoBFT. It includes a block header, a sequence of batch certificates, ratifications, solutions, transactions, and a list of aborted transmission IDs.

The true mark of a successful blockchain lies in its ability to foster a vibrant community and diverse applications. Aleo boasts a rapidly growing ecosystem with projects already exploring its potential across various domains:

Talking about recent updates - Aleo is now considered as one of the top 5 fastest-growing ecosystems for overall developers. Also, Aleo has completed the security audits of snarkOS & snarkVM, which was performed by Trail of Bits.

Aleo worked hard to make the technical details of the project easier to understand. They've simplified and explained the main basics in a straightforward way. For example:

As a validator and staking infrastructure provider, Chorus One is deeply impressed by Aleo's groundbreaking approach to privacy in the blockchain space. The potential to unlock entirely new use cases and empower individuals with greater control over their data resonates deeply with our mission to build a more inclusive and accessible crypto ecosystem.

We're particularly excited about the unique technology stack, including snarkOS and snarkVM, which pave the way for scalable and efficient privacy-preserving applications. We believe Aleo has the potential to significantly impact various industries, from DeFi and healthcare to supply chain management, and Chorus One is proud to be a part of this journey. We are looking forward to actively contributing to the network's security and growth through staking infrastructure and look forward to witnessing Aleo's continued development and the exciting applications it enables.

Website: https://aleo.org/

Twitter: https://twitter.com/AleoHQ

Youtube: https://www.youtube.com/@AleoLabs/featured

Github: https://github.com/AleoHQ

Discord: https://discord.gg/aleo

About Chorus One

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 50+ Proof-of-Stake networks, including Ethereum, Cosmos, Solana, Avalanche, and Near, amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.

Since its introduction in 2008, the Bitcoin whitepaper has marked the beginning of a transformative journey. Nations have embraced it as official currency, companies have added Bitcoin to their assets, and in 2024, Bitcoin ETFs are actively being traded. Despite these advancements, Bitcoin has struggled to shed the perception of being merely a store of value, akin to digital gold. While it's true that facilitating smart contracts was not Bitcoin's initial aim, the explosive growth of decentralized finance (DeFi) prompts a thought-provoking question: could the functionalities of DeFi be integrated into Bitcoin?

This is where Bitcoin Layer 2 solutions, or L2s, come into play. Below, we'll delve into one of the most thrilling projects in this realm - Stacks.

⚡️Chorus One is proud to join the latest team of signers on Stacks and further enhance the network’s security and decentralization. Learn more here.

It's widely acknowledged that Bitcoin stands as the most decentralized and secure blockchain. However, the high cost of its block space, low TPS, along with the need for additional computing resources among other factors, have made the development of smart contracts on its platform particularly challenging. This situation paved the way for the emergence of networks dedicated to smart contracting, such as Ethereum. Stacks, however, offers a solution to this issue.

Stacks is a novel layer built atop Bitcoin and it extends the utility of the most secure and decentralized blockchain by introducing smart contracts and dApps functionalities without altering Bitcoin's core protocol. This integration is facilitated through the Proof of Transfer (PoX) consensus mechanism, a pioneering approach that reuses Bitcoin’s Proof of Work (PoW) to secure the Stacks network, enabling smart contracts that directly interact with Bitcoin state and transactions. The goal of the Stacks layer is to grow the Bitcoin economy, by turning BTC into a productive rather than passive asset, and by enabling various decentralized applications. The Stacks layer has its own global ledger and execution environment, to support smart contracts and to not overwhelm the Bitcoin blockchain with additional transactions. It also provides mechanisms for higher performance, such as fast blocks, decentralized peg, and subnets.

The question of the necessity for a Bitcoin Layer 2 revolves around the potential of integrating fully-expressive smart contracts into Bitcoin. Successfully embedding such functionality could revolutionize Bitcoin's application, ushering in new use cases worth hundreds of billions, including stablecoins, NFTs, and Automated Market Makers (AMMs). This evolution would transform Bitcoin from a passive asset into a cornerstone of digital finance, significantly boosting its demand, value, and utility by enabling a wide array of yet-to-be-explored applications.

For blockchains with native smart contract capabilities, essential features include the ability for smart contracts to be fully secured by the network's security mechanisms, such as hash power in Proof of Work (PoW) systems or staked assets in Proof of Stake (PoS) systems. This ensures that smart contracts benefit from the same level of security as the underlying blockchain. The smart contracts not only need to have ‘read’ but also ‘write’ capabilities. As a layer on top of Bitcoin, Stacks plans to bring these features to Bitcoin through the following elements:

STX: STX, the native token of Stacks, plays a pivotal role in the PoX (Proof-of-Transfer) consensus mechanism, serving two main functions: (a) incentivizing miners to secure the Stacks global ledger, which operates independently of Bitcoin's Layer 1, and (b) ensuring the operational continuity of the sBTC peg by providing rewards to threshold signers involved in the peg mechanism. STX was distributed to the public through the first-ever SEC-qualified token offering in US history and currently enjoys a market capitalization of over $4B.

PoX: Proof of Transfer (PoX) is a unique consensus mechanism to the Stacks blockchain that is designed to leverage the security and robustness of Bitcoin, while allowing Stacks to introduce smart contracts and decentralized applications (dApps) on top of Bitcoin. In typical Proof-of-work (PoW) systems, miners must solve complex mathematical problems. In PoX, miners must transfer a base cryptocurrency (in this case Bitcoin) to join the mining process. This Bitcoin is transferred to STX holders that participate in the network by sta(c)king their STX STX tokens, thus securing the network. So in PoX, you’re bidding Bitcoin in the hopes of being selected to add the next block to the chain versus committing computation power in the case of PoW. Like other networks, the miners on Stacks get block rewards but in STX and not BTC. This dual mechanism integrates the economic incentives of both Bitcoin and Stacks.

Stacking: Stacking is not staking, but the fundamental concept is very similar. Staking involves locking up token X and getting rewards with staking yields in the same token X. Eg - Stake SOL and get rewarded in SOL. Stacking mandates depositing STX tokens to get rewarded in a different token (BTC). This synergy between BTC and STX is interesting and actually incentivizes BTC holders to participate in the STX ecosystem. STX holders on the other side are incentivized to stack their tokens to be rewarded in arguably the most decentralized and secure cryptocurrency token BTC.

Signing: Post the Nakamoto release, the role between Miners and Stackers has been segregated. Where previously, miners decided the contents of the block and also decided whether or not to include them in the Stacks chain, now they would only be deciding the contents of the block and the stackers would be taking on the role of deciding whether to include them in the block or not. Stackers validate and sign blocks through a distributed signing protocol, requiring a significant fraction of locked STX to agree on block inclusion, thus preventing forks and enhancing the chain's integrity. Chorus One is proud to join the team of signers on Stacks along with other industry leaders likeBlockdaemon, NEAR Foundation, DeSpread, Alum Labs, Kiln, Luganodes, Copper, and Figment.

sBTC: sBTC is a fungible token that is pegged 1:1 with Bitcoin to enable Bitcoin holders to participate in the Stacks ecosystem. Users who want to interact with BTC and developers who want to create apps with BTC programmability can both use sBTC, thereby extending BTC’s utility beyond Bitcoin. To deposit BTC into sBTC, a Bitcoin holder would create a deposit transaction on the Bitcoin chain. This deposit transaction informs the protocol of how much BTC the holder has deposited, and to which Stacks address the holder wishes to receive the sBTC. The sBTC system responds to the deposit transaction by minting sBTC to the given Stacks address. To withdraw BTC, a Bitcoin holder creates a withdrawal transaction on the Bitcoin chain. This withdrawal transaction informs the protocol of how much sBTC the holder wishes to withdraw, from which Stacks address the sBTC should be withdrawn, and which Bitcoin address should receive the withdrawn BTC. In response to this transaction, the sBTC system burns the requested amount of sBTC from the given Stacks address and fulfills the withdrawal by issuing a BTC payment to the given BTC address with the same amount.

Clarity: Stacks also has its native programming language called Clarity, crafted with a focus on safety and security. The inspiration for Clarity's development was drawn from analyzing and addressing vulnerabilities commonly found in Solidity. By integrating these lessons, Clarity was meticulously designed to offer a secure coding environment, prioritizing the prevention of exploits right from its core. You can read more about Clarity in the online book - Clarity of Mind.

Total supply: ~1.82B

APY: 6% (BTC)

We currently support infrastructure for over 50 networks, and we're thrilled to announce that Stacks will mark our inaugural support for a Bitcoin Layer 2 solution. This is a significant milestone for Chorus One, largely due to the exceptional team behind Stacks, whose expertise and dedication have been evident over many years of development.

If you have STX tokens and would like to stack them, feel free to reach out to one of our experts at staking@chorus.one.

To read more about Stacks, we recommend the official documentation available in docs.stacks.co.

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 50+ Proof-of-Stake networks, including Ethereum, Cosmos, Solana, Avalanche, and Near, amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.

Summary

A technical in-depth guide of our OPUS Pool to demystify pooled staking with Stakewise and restaking osETH on Eigenlayer with Chorus One.In a nutshell, the steps are as follows:

These simple steps will get you ready to participate in the restaking ecosystem. If you’re interested in reading more about what happens in each step, below we will unravel what happens under the hood.

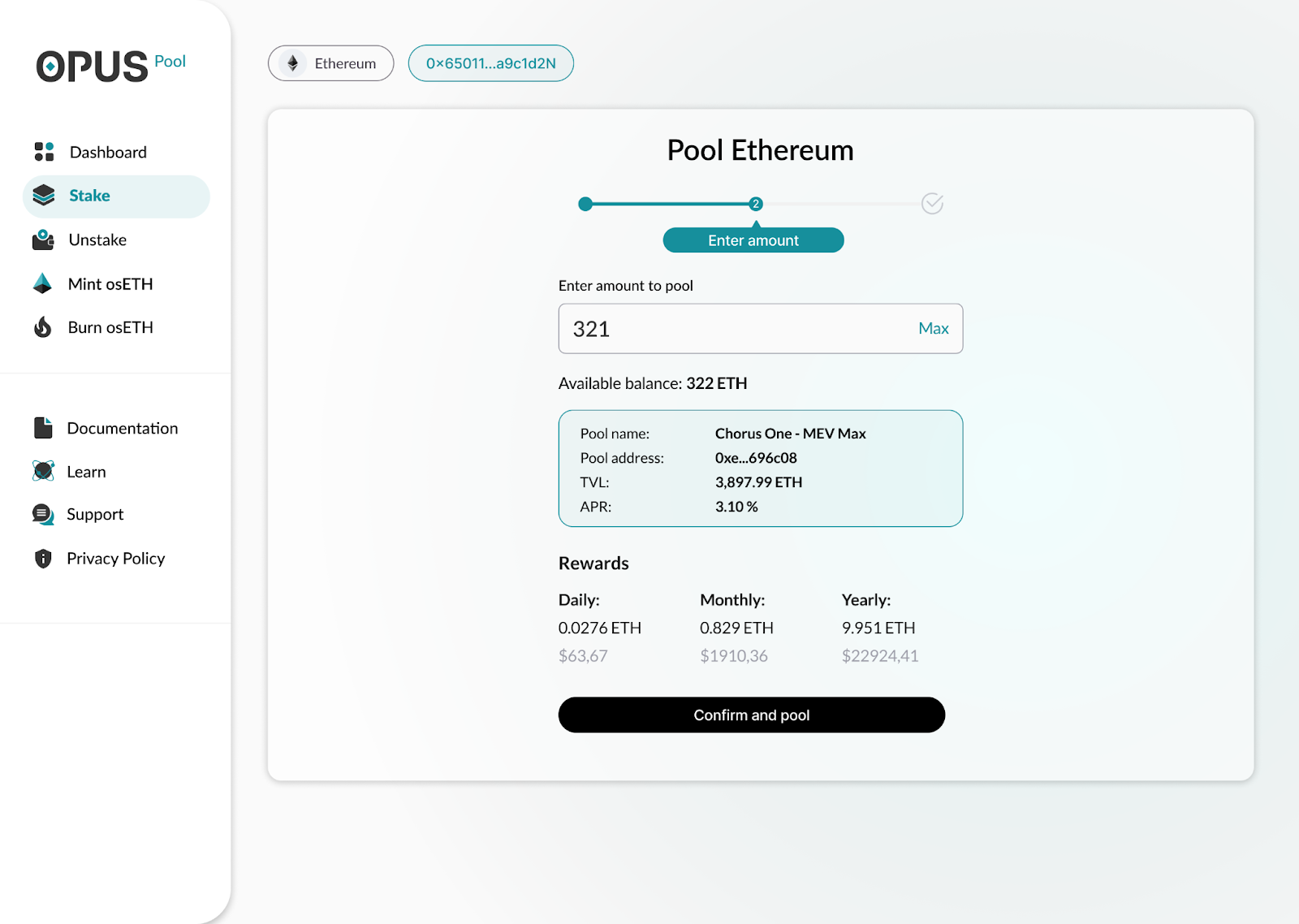

Go to Opus Pool, connect your wallet and deposit some ETH into our Stakewise vault. Traditional staking usually requires a staker to deposit 32ETH to spin up a validator on Ethereum in order to start earning rewards. Our 1-click staking experience enables users to stake any amount, powered by Stakewise. Stakewise v3 offers a permissionless, non-custodial pooled staking solution enabling any node operator to create a “vault”. A vault is essentially an isolated staking pool managed by the node operator and providing an automated process for ETH deposits, reward distribution, and withdrawals. You can learn more about Stakewise in our extensive guide here.

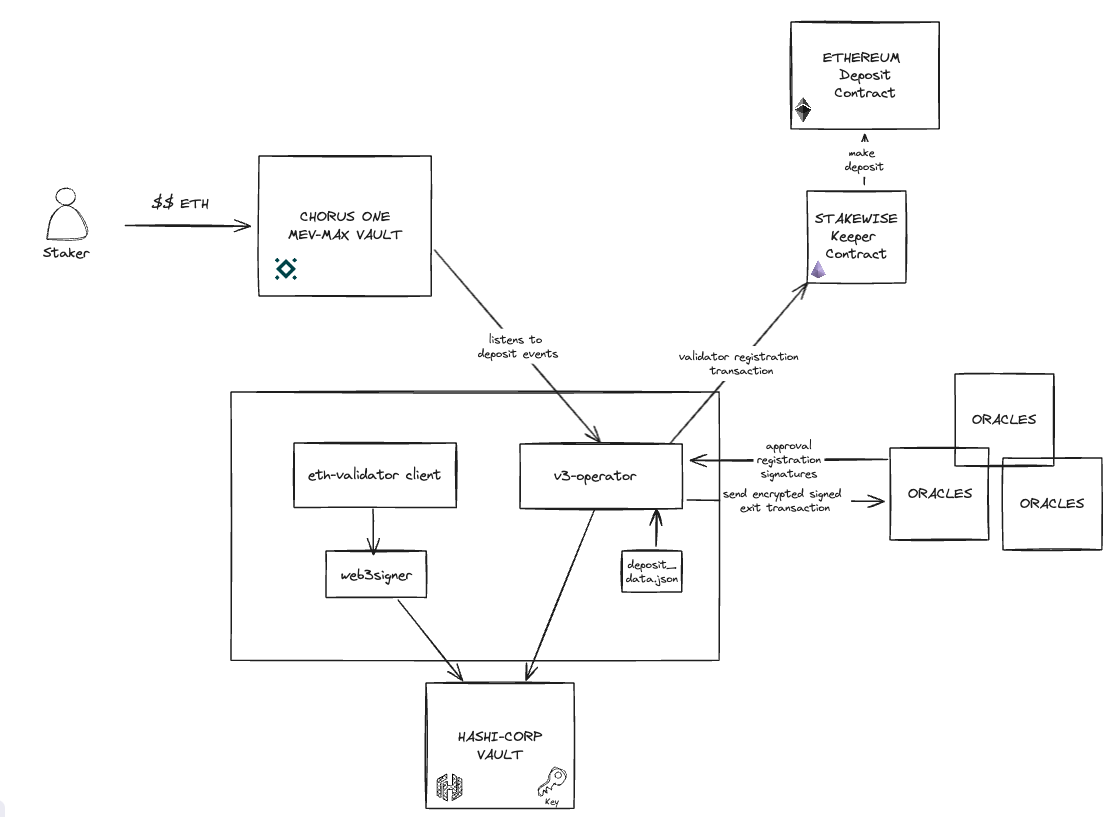

Under the hood: On a more technical level, when you stake into our Stakewise Pool, the flow works as follows:

A user deposits ETH into our MAX-MeV Stakewise vault. Once enough ETH has accrued (32 ETH), we can deposit a new validator in our vault. This is done by running an additional piece of software, stakewise v3-operator, alongside our usual Ethereum validator infrastructure, which listens to Deposit events and initiates the validator registration process. This architecture offers some very unique features. For one, the permissionless onboarding. Stakewise makes it possible to create your own vault with customized experiences, such as a private vault- only allowing stake from whitelisted addresses, a public vault- allowing stake from everyone, MEV smoothing and many more. Secondly, the ability to initiate a forced-exit by the Stakewise DAO. The Ethereum protocol requires validator exit messages to be signed with the validator signing key (the key held by the node operator required to operate the validator for signing blocks and attestations).

This means that, until EIP-7002 is implemented to support signing exit messages with withdrawal credentials (the key the staker holds to withdraw their funds), users depend on the node operators to exit validators on their behalf. To remediate this potential attack vector in a fully permissionless environment, there are certain steps a node operator must go through when registering a new validator. They submit shards of their signing keys to all Oracles through a process known as Shamir-secret sharing, a secret sharing algorithm which enables trustless and secure sharing of distributed, private information. Moreover, the pre-signed exit transaction messages are sent to the oracles in an encrypted manner. This allows the DAO to exit a validator on their behalf, should a node operator go rogue. Once oracles have approved registration, the operator sends the validator registration transaction to the so-called Keeper contract- essentially the brain in the architecture- which executes the deposit on-chain. EIP-7002 is still in its design phase, but it will open up new solutions to remove the need for Oracles by enabling the execution layer to trigger validator exits under certain conditions.

After a successful validator registration process, we’re ready to run a validator and collect rewards in our vault. Similarly to other liquid staking protocols, Stakewise relies on several oracles to fetch rewards from the Beacon Chain. Since The Merge, Ethereum’s architecture consists of the Consensus Layer (“Beacon Chain” which contains the consensus state and validator management) and the Execution Layer (“the EVM” which handles execution payloads, maintains a mempool of transactions). While combining both layers facilitated an easy transition to a Proof-of-Stake chain, it left the communication between both layers via Engine API somewhat limited- the Consensus Layer can query the Execution layer, but not the other way round. Essentially this means there’s no trustless way for the EVM to connect to the Beacon Chain to e.g. fetch validator rewards data. As a workaround, Stakewise employs trusted Oracles which regularly fetch rewards data from the Beacon Chain and vote for the rewards/penalties from all vaults. The vault rewards are saved as a Merkle tree and uploaded to IPFS, e.g see this example. The Merkle root is saved in the Keepers contract, again, the brain of our architecture. If you’re not familiar with Merkle trees, proofs and roots, they are one of the founding blocks of how Ethereum works, here’s a recommended read.

Essentially, it’s a data structure that helps us verify data consistency and make efficient proofs of inclusion (Merkle-proofs) to verify a piece of data is in the tree. More concretely, since the Merkle root is stored in the Keepers contract, it’s easy to verify that the stored Merkle tree hasn’t been tampered with.

To keep a vault’s state up to date, the Keeper contract needs to be “harvested”, meaning that the vault can fetch the Merkle root from the Keeper and derive validators rewards/penalties to update its state. If the state isn’t updated in a specified timeframe, any user interaction will be blocked.

With EIP-4788, which is implemented in the upcoming Dencun Upgrade (currently being rolled out to all testnets), the parent (previous) beacon block root will be included directly into the execution block enabling the EVM to access the block root from a trusted source, and thus removing the need for an Oracle and instead, enshrining it in the protocol. The way it will work is similar to the implemented workaround- the parent beacon block root represents the hash of the entire header of the previous block. A smart contract deployed on Ethereum will hold a limited number of parent beacon block roots, such that the execution layer can derive the consensus state in a trustless manner.

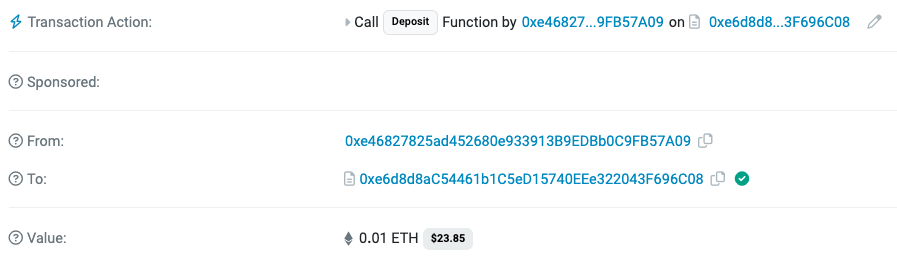

With this foundational knowledge in mind, let’s look at a specific example transaction of someone depositing 0.01 ETH into our Stakewise vault:

You can see the address which deposited 0xe46825... calls the deposit function on the Chorus One vault address 0xe6d8d8… . As we mentioned in the previous section, the v3-operator listens to DepositEvents emitted. Looking at the event logs, we get a good glimpse into what happens when you deposit into a vault:

The address is recorded along with the amount of your stake (assets), resulting in a number of “shares”which are calculated as follows: assets * total shares in vault / total assets in vault, see contract code for reference. The calculated shares will be the indicator how much of the rewards accrued by the Ethereum validator will be paid out to the staking address.

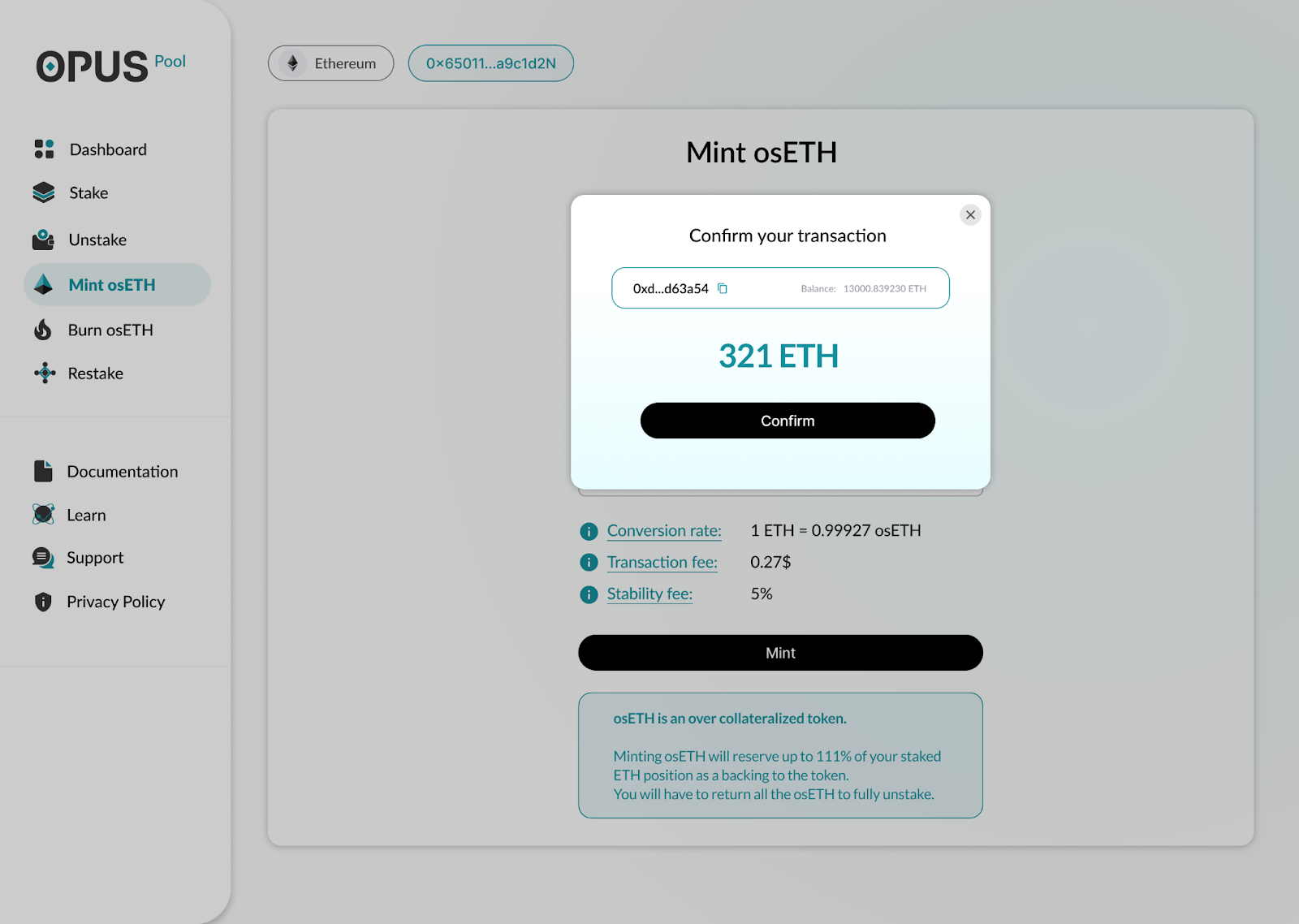

Once you’ve deposited successfully in our Stakewise vault, you can go ahead and mint your osETH in 1-click. The minted osETH should be visible in your wallet after the transaction was successful. If it’s not visible, you may need to add the token manually, e.g. for MetaMask see this resource.

Under the hood: As mentioned above, Stakewise offers a liquid staking token called osETH to provide liquidity to its stakers. This is a fantastic improvement on the staking experience, because you get a representation of your staked ETH which you can use to earn additional yield in the DeFi world. During vault setup, a node operator may choose to configure a vault that allows to mint an ERC20 token or whether the vault is tokenless. The issued liquid staking token- osETH- is overcollateralized, meaning the underlying assets in the vault are worth more than the osETH issued in order to cover potential losses from slashing. The biggest risk for staking is the risk of getting slashed, e.g due to double signing, which could result in losing part of the stake. Slashing is usually the consequence of bad key management practices that optimise for speed rather than consistency. It’s therefore important for node operators to apply sound security and key management practices, in order to minimize the risk.

One interesting feature of osETH is that it has a built-in slashing protection mechanism for its stakers. During the minting process you might have noticed that you can only mint up to 90% of the staked ETH. The excess backing insures stakers against poor staking performance or slashing events. Such penalties are absorbed by the excess backing.

To keep track of this, Stakewise defines a certain parameter known as “position health” which monitors the value of osETH minted relative to the value of their ETH currently staked in the Vault (see in screenshot above). The value can be Healthy/Moderate/Risky/Unhealthy. A “Healthy” position means that minted osETH doesn’t exceed 90% of the staked ETH. If the value of minted osETH grows faster and suddenly exceeds 92% of the staked ETH in the vault, the position status will move to “Unhealthy”. Let’s look at a concrete example: Imagine a user minted osETH against a staked position worth 100 ETH in Vault X. Suddenly, Vault X decided to increase its fees much higher than other vaults. During an incident, the node operator was forced to migrate their keys and started producing inconsistent attestations and downtime causing inactivity leaks all resulting in penalties and lower profit accrued in the vault. On top of that the bull market hits and demand for Ethereum validator exceeds current supply making the validator activation queue extremely long, but still growing overall TVL. A month later the minted osETH is now worth 92.01 ETH, making the user's position status "Unhealthy" and opening up for liquidation because the value of minted osETH relative to their ETH stake exceeds the liquidation threshold, i.e. is >92% enabling the DAO to liquidate a vault (if you remember, they have the ability to exit validators on a node operator's behalf), in order to ensure the excess backing of osETH.

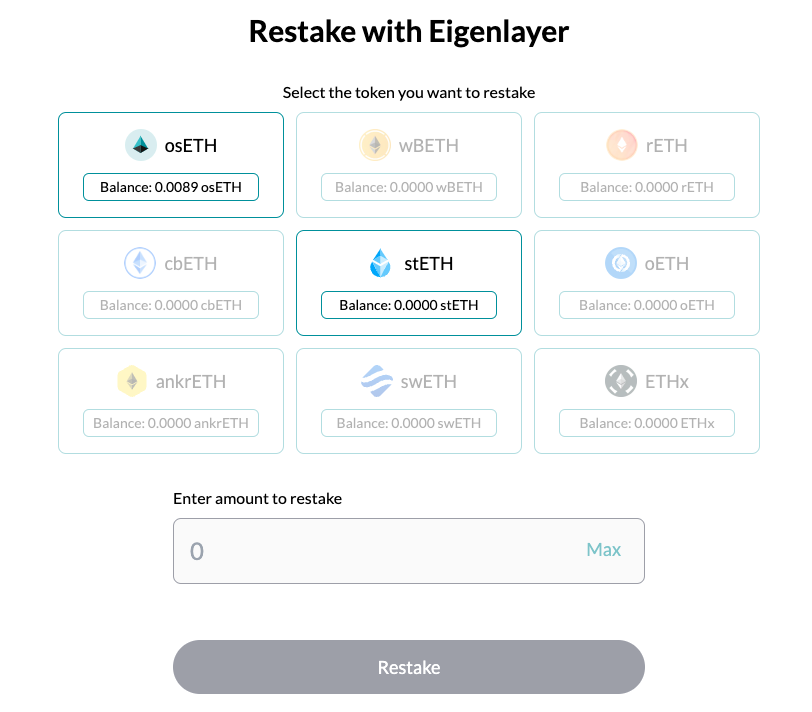

The final step in our OPUS Pool journey let’s you restake your freshly minted osETH and other liquid staking tokens with EigenLayer.

Now what’s Eigenlayer and why will it bring more yield? To sum it up: “Restaking offers stakers the flexibility to contribute to the security of multiple networks, potentially earning rewards, verifying trust, or engaging in blockchain events. Users that stake $ETH can opt-in to EigenLayer smart contracts to restake their $ETH and extend cryptoeconomic security to additional applications on the network”. To read more about how it works, head to our blog article on Eigenlayer.

Under the hood: As of the time of writing, no AVS are live on mainnet yet. Until the EigenLayer protocol goes live with EigenDA (AVS developed by the EigenLayer team), restakers will receive restaked points as a measure of the user’s contribution to the pooled security, while securing the opportunity to be rewarded as an early restaker. Once AVSs go live, you will be able to delegate to Chorus One and receive rewards from your restaked ETH or Liquid Staking Tokens. This graph below shows what will happen once we enter this Stage:

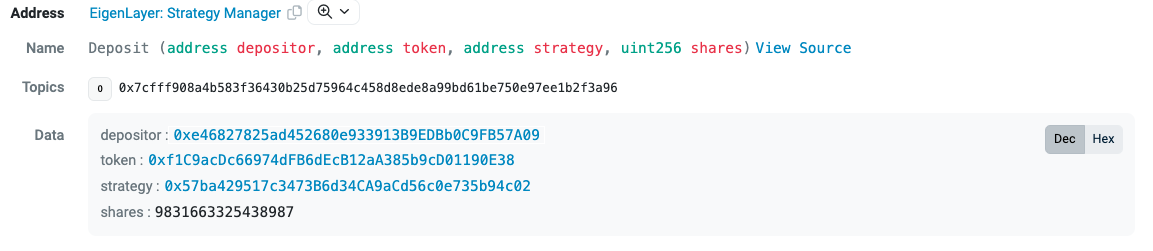

The (re-)staker deposits their osETH (or other Liquid Staking Tokens) into the EigenLayer StrategyManager contract, which is responsible for accounting and allowing restakers to deposit LSTs into the given strategy contract. When users deposit into the StrategyManager, the funds are transferred to the respective LST’s StrategyBaseTVLLimits contract e.g. osETH or stETH, which returns shares proportionally to the users stake. The number of shares is calculated using an internal exchange rate which depends on the total number of deposits.

Here’s an example transaction of a user depositing osETH into the StrategyManager via our OPUS Pool. The event logs show the address where the funds were deposited from (depositor), the address of the token contract (in this case osETH token contract), and the address of the strategy contract (the address of the osETH strategyBaseTvlLimits contract).

Once the AVSs go live on mainnet, restakers will be able to delegate their LSTs to Chorus One. This is done by calling a function on the DelegationManager which manages delegation and undelegation of the stakers to operators. As of now, this functionality is paused, so stay tuned for the next EigenLayer mainnet upgrade and don’t miss your chance to delegate your restaked tokens to your favourite node operator.

A step-by-step guide to staking ETH on OPUS Pool

Restake with EigenLayer Seamlessly via Chorus One's OPUS Pool: A Detailed Guide

Learn more about Adagio, Chorus One’s pioneering Ethereum MEV-Boost client

MEV Max - Introducing Chorus One’s Liquid Staking Pool on Stakewise V3

Considerations on the Future of Ethereum Staking

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 50+ Proof-of-Stake networks, including Ethereum, Cosmos, Solana, Avalanche, and Near, amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.

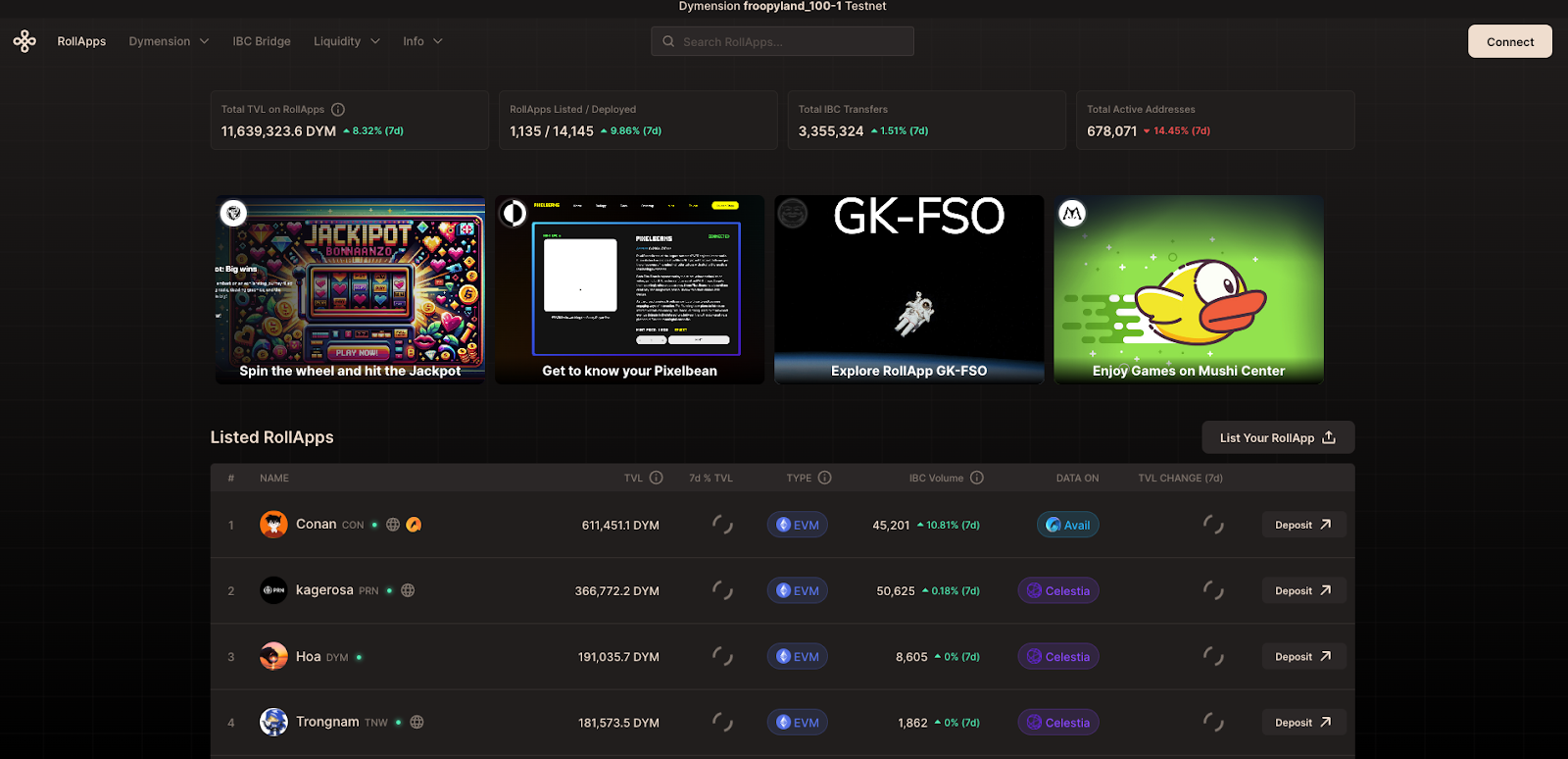

After what might have been the most anticipated launch so far, we're thrilled to be part of the continued innovation of blockchain technology by championing Dymension, as they work to pioneer the 'Internet of RollApps' with their unique modular features. Chorus One runs a public validator node and has also invested in Dymension through Chorus Ventures.

Dymension makes it easy for anyone to create and deploy their own blockchain, while providing its users the infrastructure and flexibility to scale and compete with other modern-day blockchain implementations.

In this guide, we'll cover what Dymension is and how it's pushing the boundaries of blockchain capabilities.

Unlike traditional blockchains that integrate data availability, consensus, settlement, and execution into a single layer, Dymension adopts a modular approach. This innovative method allows delegating one or more of these components to external chains, significantly enhancing performance, scalability, and efficiency.

Dymension aims to improve upon the current reliance on shared bandwidth systems used by many popular blockchains by using a multi-layer blockchain protocol. Consisting of a network of modular blockchains, known as "RollApps", these blockchains are powered by the Dymension Hub which is responsible for both consensus and settlement.

While initially the Dymension team will oversee RollApp approvals, the network aims to evolve into a permissionless ecosystem with the ultimate goal of serving as a decentralization router that connects RollApps to the crypto economy. In the long run, this will allow Dymension to be a "Internet Service Provider" for crypto and blockchain technologies.

To further detail its architecture, Dymension utilizes the Cosmos SDK for interoperability across blockchains, enabling RollApps to efficiently communicate and transact. The use of Tendermint Core for consensus ensures high security and fast transactions across the network. This technical foundation allows Dymension to support a wide range of applications, from finance to gaming, by providing developers with the tools to create highly scalable and customizable solutions.

As Dymension evolves, its architecture is designed to support a growing ecosystem of decentralized applications, ultimately facilitating a seamless connection between users and blockchain services on a global scale.

Dymension's unique proposition lies in its sophisticated modular architecture, designed to decentralize and optimize the components of blockchain functionality. By enabling external chains to handle aspects like data availability, consensus, and execution separately, it aims to not only significantly boost performance but also provide improved scalability and efficiency for all.

Here's how the Dymension team explains the ecosystem:

Dymension is similar to a full-stack web application where users interact with RollApps (front-end), Dymension (back-end) acts as the coordinator for the ecosystem, and the data availability networks (database) provide a place to publicize data.

Using the Cosmos SDK, Dymension incorporates a staking mechanism that enables participants to stake or unstake tokens with validators. This feature is central to maintaining the security and integrity of the network, allowing stakeholders to contribute to the ecosystem actively.

To kick off Genesis Rolldrop Season 1, Dymension is working to incentivize its users and builders by providing a significant allocation of tokens to pay tribute to three verticals within crypto, culture, money, and tech.

The tokenomics ($DYM) as of Feb 6th is as follows:

Total Supply: 1,000,000,000

Chorus One Valoper address: dymvaloper1ema6flggqeakw3795cawttxfjspa48l4x0e2mh

The Inter-Blockchain Communication Protocol is an important aspect of Dymension. IBC is a battle-tested bridging protocol that allows secure communication between different chains. RollApps connect to the IBC economy via Dymension Hub, similar to how a server connects to the internet via an internet service provider.

Dymension is working to reduce the reliance on centralized and commonly used multi-sig bridges prevalent in Ethereum and L2 ecosystems with IBC-connected rollups. By utilizing IBC for rollups, Dymension validates that all funds deposited into a RollApp are as secure as the Dymension Hub itself.

We firmly believe Dymension stands at the forefront of the next generation of blockchain technology, with its modular architecture promising to improve upon scalability and efficiency challenges faced by traditional blockchains. As supporters and collaborators, we continue to advise the team to best position themselves for a successful mainnet launch and beyond.

We are excited about the potential of Dymension to revolutionize the blockchain ecosystem, reinforcing our commitment to innovation and the growth of blockchain technology.

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 50+ Proof-of-Stake networks, including Ethereum, Cosmos, Solana, Avalanche, and Near, amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.

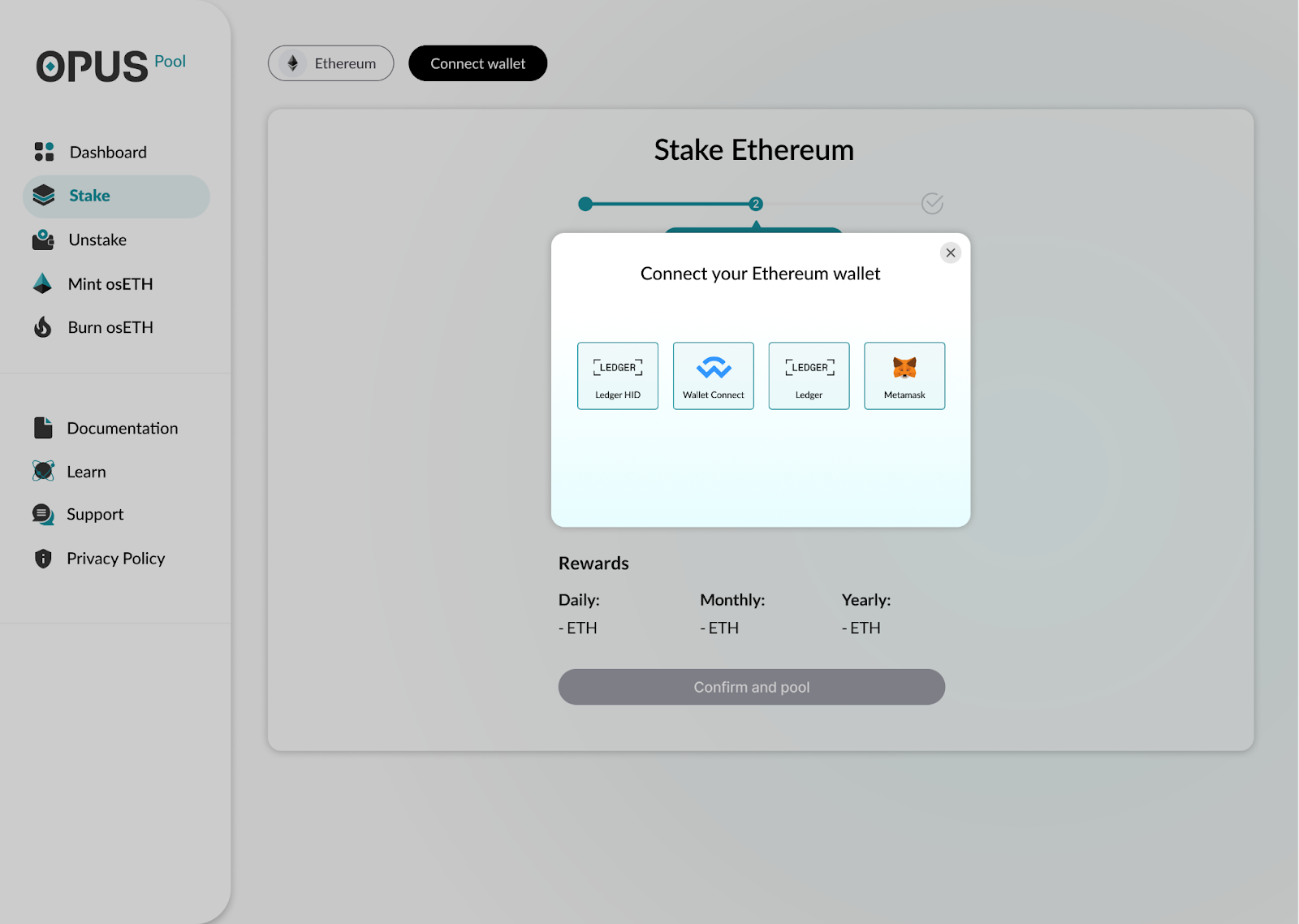

OPUS Pool, powered by Stakewise, is our latest addition to the OPUS product suite which enables anyone to stake any amount of ETH with Chorus One, mint osETH, and directly deposit into EigenLayer in one flow.

Not only that, users may bring in liquid staking tokens (LST's) from any external platform, including osETH, wbETH, rETH, cbETH, stETH, oETH , ankrETH , swETH, ETHx, and directly restake with EigenLayer if they wish to do so.

Start using OPUS Pool to stake ETH. Visit https://opus.chorus.one/pool/stake/

OPUS Pool facilitates greater participation in securing the network but also allows a wider range of Chorus One stakers to earn rewards and gain access to a suite of benefits, including top-tier MEV yields, low fees, and the assurance of enterprise-grade security, among others.

Below, we will take you through the steps of how you can use OPUS Pool to

Before moving on to the guide, let’s first take a look at some of the benefits of using the OPUS Pool.

As previously mentioned, the OPUS Pool enables any user to stake any amount of ETH and receive rewards instantly. Additionally, users have the ability to mint osETH, a liquid staking derivative, and use it in DeFi or deposit into EigenLayer to gain additional rewards directly on OPUS Pool in one go.

This means that you do not have to switch between platforms to Stake and Restake your ETH (an industry first! ).

The OPUS Pool sets itself apart from current liquid staking protocols by offering users the advantage of highly competitive staking fees. At just 5%, our fees are among the lowest in the industry, making it more accessible for a broader spectrum of users to stake their ETH and earn rewards.

As pioneers in MEV research, our latest ace, Adagio, is an MEV-Boost client that changes how transactions are handled for increased MEV capture.

Adagio's design allows for more efficient interactions with Ethereum’s transaction supply chain, directly enhancing MEV rewards for stakers. Fully integrated with OPUS Pool validators, Adagio ensures that anyone staking on OPUS Pool can benefit from these increased MEV rewards.

Want to learn more about Adagio and its mechanics? Read all about it here.

OPUS Pool offers a unique feature: users can deposit not only osETH minted through OPUS Pool but also liquid staking derivatives like osETH, stETH, cbETH, and rETH minted on other platforms, directly into EigenLayer.

This flexibility allows users to either mint osETH with OPUS Pool and deposit it into EigenLayer, or bring in any accepted liquid staking derivatives and seamlessly deposit them into EigenLayer in a single step.

The OPUS SDK : In addition to the benefits mentioned above, our Institutional clients can leverage the OPUS SDK to integrate ETH staking into their offerings, providing their customers with all the benefits of the OPUS Pool seamlessly. To know more, please reach out to staking@chorus.one.

We’ve covered all the benefits, and in-depth overview of the OPUS Pool and how it works in our blog. Check it out here.

Now, let’s move on the guide.

💡Remember, you can directly Restake your staked ETH (including osETH, wbETH, rETH, cbETH, stETH, oETH , ankrETH , swETH, ETHx ) by skipping directly to Step 3: Restake with EigenLayer, if you do not wish to stake ETH and mint osETH on the OPUS Pool first!

We will walk you through each option in this guide.

To start staking, enter the amount of ETH you would like to stake. Once you have done this, click on ‘Confirm and Pool’.

5. Confirm your transaction.

1. To unstake from OPUS Pool, click on the ‘Unstake’ in the menu on the left navigation bar.

2. Then enter the amount of ETH you would like to unstake.

3. Confirm the transaction

4. After confirming the transaction, please save the transaction hash for your records.

6. After the 8-day escrow period, please connect to the Chorus One MEV-MAX vault on Stakewisev3 at https://app.stakewise.io/vault/0xe6d8d8ac54461b1c5ed15740eee322043f696c08

7. The unstaked ETH will be available to withdraw from the vault. Please click on “Claim” to withdraw the funds to your wallet.

You have now successfully unstaked from OPUS Pool.

To learn more about the OPUS Pool, visit our blog here.

To learn more about EigenLayer, visit our introductory blog here.

If you have any questions, or want more information, or interested in the OPUS SDK, please reach out at staking@chorus.one, and we’ll be in touch!

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 50+ Proof-of-Stake networks including Ethereum, Cosmos, Solana, Avalanche, and Near amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.