We’re proud to launch our liquid staking pool on Stakewise v3, enabling individuals to stake any amount of ETH and benefit from Chorus One’s enterprise-grade staking infrastructure and industry-leading MEV yields! Additionally, staking on Chorus One’s pool enables users to un-stake at any time, or utilize their staked ETH capital throughout DeFi. You can start staking with on Chorus One’s pool here .

We're also introducing exclusive Private Vaults tailored for our institutional clients and investors who desire a dedicated liquid staking solution. These personalized Vaults come with individual agreements, ensuring user assets remain distinct and aren't mixed with other Vaults.

Additionally, in the upcoming months, we plan to deepen our collaboration by seamlessly integrating our public Vault into our Staking Dashboard. This integration will make it incredibly easy for OPUS customers to access liquid staking and mint osETH, enabling them to participate in the DeFi space effortlessly. Stay tuned for more updates!

Below, we dive into some of the key details about Stakewise and how you can start staking ETH on Chorus One’s Vaults.

Stakewise v3 represents the latest version of the Stakewise protocol, announced by the Stakewise DAO in 2022.

V3 was conceived to tackle the issue of stake centralization, a significant challenge impacting the security and well-being of Ethereum. Setting up Ethereum validators has traditionally been complex for node operators, with factors like the 32ETH minimum requirement, technical and hardware demands, and the risk of financial penalties for validator mistakes. Consequently, there has been a decline in solo stakers engaging in individual ETH staking. Many have opted to outsource validator operations to commercial node operators, who possess the expertise, hardware, and security measures required to establish validator nodes for individuals and organizations with 32 ETH.

Stakewise v3 tackles this challenge by elevating its existing liquid staking solution, introducing mini staking pools referred to as "Vaults." These Vaults empower individuals, node operators, or organizations to effortlessly launch their own nodes, mint staked ETH (osETH) tokens against those nodes, accept delegations, or delegate any amount of ETH across multiple nodes to mitigate network concentration.

Importantly, each Vault or mini Pool is entirely agnostic to the configurations set up by its operator. This means that the operator can fully customize its vault according to its own design, allowing users to select a vault based on features that best suit the depositor. Whatever client solutions, KYC features, MEV relays the entity wishes to run are under their control, resulting in a diverse marketplace of staking solutions for users to explore and choose from.

Moreover, users can establish private pools, allowing deposits only from addresses whitelisted by the Vault Operator. This ring-fences the Vault, ensuring that staked assets are not co-mingled with funds from other Vaults.

We've covered everything you need to know about how Stakewise v3 works and its use cases for solo stakers, institutions, DeFi users, and commercial node operators in this guide. Check it out!

For investors

Previously, staking ETH was restricted to investors and institutions with a minimum of 32 ETH. They could delegate validator maintenance responsibilities to an experienced node operator like Chorus One, known for its enterprise-grade staking infrastructure.

By staking on Chorus One’s Pool on Stakewise v3, anyone with any amount of ETH can now access the same infrastructure and benefits as our institutional customers. This opens doors for a significantly larger number of individuals to safely and seamlessly stake and unstake their ETH without any minimum requirements.

Chorus One has garnered widespread recognition for our dedication to research and the implementation of strategies aimed at enhancing our MEV performance. We consistently optimize our infrastructure to maximize MEV rewards.

The following graph illustrates our performance over a 60-day period. Over this time period, Chorus One nodes have captured close to 14% more MEV rewards per validator (ETH) when compared to the weighted industry average, observed on Lido.

*Please note that this is a snapshot, and that MEV rewards fluctuate as a function of variance and market conditions. Please visit Rated Network to view the latest figures.

To learn more about the work we’ve done in in spearheading MEV research in the industry, please visit our dedicated MEV page.

We are one of the very few node operators to hold the ISO 27001:2022 certification, representing the industry standard for implementing top-tier security practices. Safeguarding customer assets and data is our utmost priority, ensuring users that their funds are in experienced hands.

Our in-house team of researchers and experts consistently scrutinizes the crypto ecosystem and the Ethereum network with a keen eye. We regularly publish reports and analyses addressing current industry issues, providing fresh insights based on our expertise. We are dedicated to ongoing improvement, constantly exploring opportunities to enhance our performance and deepen our understanding of the network in ambition to improve the overall experience and rewards for our customers.

For institutions

Our institutional clients have the option to establish their own secure vault, operated exclusively by Chorus One. This choice allows them to implement additional measures to safeguard their funds, ensuring that staked assets remain isolated from other vaults. Opting for Chorus One as the operator of their private vaults provides institutions with the assurance that their assets are in capable hands, coupled with the added benefits of our infrastructure, including the highest MEV yields, enhanced security, and streamlined operational processes.

In the upcoming months, OPUS customers can seamlessly stake on our liquid staking pool and earn staked ETH (osETH) directly from our Staking Dashboard. This empowers users to effortlessly access the liquid staking ecosystem with just a few clicks on our platform, allowing you to conveniently track your rewards in one place! Stay tuned for more details – coming soon! 😉

To stake ETH on Chorus One’s Vault, visit here.

If you're interested in launching a private Vault operated by Chorus One, please reach out to us at staking@chorus.one.

To delve deeper into Stakewise v3, check out our explainer guide here. For a step-by-step guide on how you can start staking on Chorus One’s Vault MEV-Max, please refer to this article.

About Chorus One

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 45+ Proof-of-Stake networks including Ethereum, Cosmos, Solana, Avalanche, and Near amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.

Stake centralisation has been the talk of Ethereum’s town in 2023. Recognizing its detrimental effect and the risk it poses for Ethereum’s security and vitality, the Stakewise DAO announced its V3 in September 2022 - a permissionless and decentralized liquid staking protocol with a novel design and a liquid staked ETH token called osETH. The primary goals of v3 were stated to reduce the degree of stake centralization on Ethereum by i) making solo staking more appealing, ii) putting the choice of node operator(s) into the user’s hands, and iii) offering a new, less risky staked ETH token standard as an alternative to prevailing models.

Chorus One is proud to partner with Stakewise to support these goals by launching our liquid staking pool on Stakewise v3, enabling individuals to stake any amount of ETH and benefit from Chorus One’s enterprise-grade staking infrastructure and highest MEV yields. Additionally, staking on Chorus One’s pool enables users to un-stake at any time, or utilize their staked ETH capital throughout DeFi.

As 2023 approaches its final weeks, over a year since Stakewise announced their V3, we take a closer look at the protocol's current state - diving into its architecture, distinctions from existing liquid staking protocols, and its potential to broaden the landscape for ETH staking amongst solo stakers and institutions.

Jordan Sutcliffe, Head of Business Development at Stakewise, aptly coined Stakewise V3 as the ‘Swiss army knife’ for ETH staking, sparking a flurry of interest from ETH enthusiasts. During the unveiling, the team revealed that the new version opens the doors for anyone capable of running Ethereum validators to engage in liquid staking and receive delegations in a permissionless manner - an approach that aims to welcome a broader range of participants, fostering control and driving decentralization within the ETH staking ecosystem.

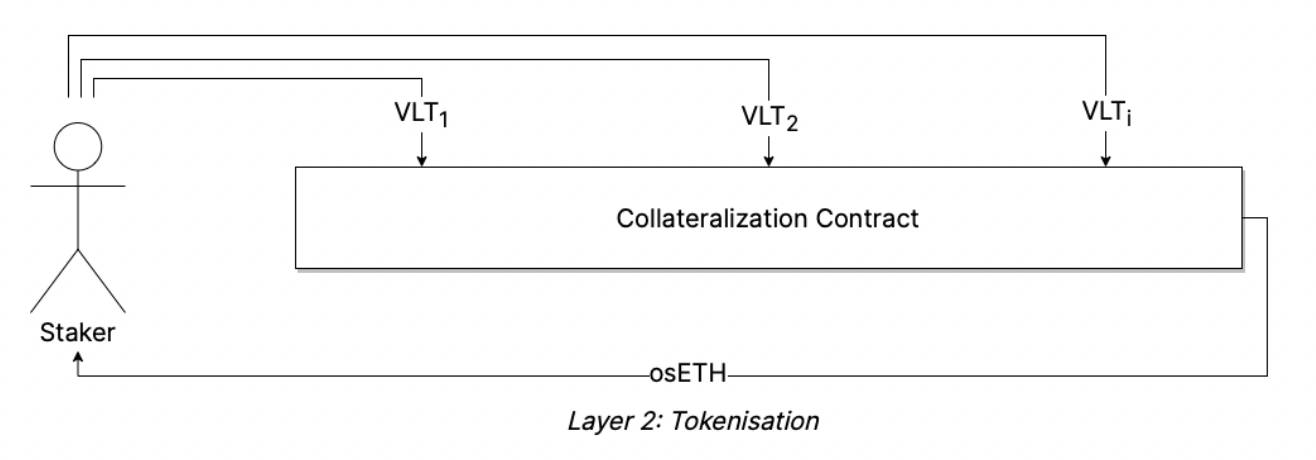

StakeWise V3 achieves this by introducing the concept of layered staking, allowing users i) to delegate ETH to a vault of the node operator(s) of their liking (1st layer), and ii) giving them the option to mint osETH to represent their stake (2nd layer). This design enables anyone to join as a solo staker who can mint osETH tokens against their node, or delegate ETH across multiple nodes to counteract network concentration. Notably, V3 introduces a slashing-resistant staked ETH token, osETH, ensuring scalability without introducing systemic risk to the broader ecosystem.

Ethereum was conceived with the mission of building a permissionless, censorship-resistant and financially robust network for value exchange.

The transition to Proof of Stake (PoS) through the Merge aimed to democratize participation, shedding the hardware and compute costs of Proof of Work (PoW). A year on from the Merge, however, centralization remains one of Ethereum’s biggest challenges - ironically, drifting towards the paradox of its own mission statement.

Currently, staking on Ethereum mandates validators to lock up 32 ETH with the network. While this investment yields interest, any misstep or dishonest conduct by a validator can lead to the revocation of funds. Setting up a validator node to stake on the network can also be a complicated task, meaning financial penalties can result if things are set up improperly.

To address this, liquid staking protocols emerged as intermediaries, enabling solo stakers and institutions to pool their ETH, collectively forming the 32 ETH required for a node. This innovation democratized ETH staking, allowing nearly anyone to participate. Intermediaries assumed the operational responsibilities, handling the pooling, staking, and technical requirements, while taking a share of the rewards for their efforts.

So, why Stakewise V3?

The drawback of the pre-existing version of Stakewise and its counterparts is simple but crucial. The absence of technical or capital requirements, the ability to temporarily exit from staking, and the increased efficiency of staked capital presented by liquid staking protocols resonate with depositors to an extent that it leads to a decrease in solo stakers (for example, individuals setting up ETH validators at home). Over time, this decline can significantly impact Ethereum’s security and decentralization.

To address this, the Stakewise DAO introduced Stakewise V3, its latest version that allows anyone—from solo stakers to established node operators to financial institutions—to participate. As a solo staker, one can seamlessly launch their own nodes, mint staked ETH (osETH) tokens against their nodes, or delegate any amount of ETH across multiple nodes to counteract network concentration.

Layer 1: Vaults

At the heart of Stakewise V3 are ‘Vaults’ - a network of permissionless, non-custodial staking mini pools that anyone can launch on the Stakewise platform and receive ETH delegations on their nodes. It offers users the freedom to stake with whichever vault they want, choosing between vaults run by solo stakers, node operator companies, and groups of solo/commercial operators.

For every 32 ETH of deposits accumulated in a Vault, the Vault operator(s) registers an Ethereum validator in the Beacon Chain and starts staking. The staking rewards belong to the depositors, net of the staking fee charged by the Vault.

Importantly, each of these Vaults is completely unique to the configurations set up by its operator, meaning that the operator can fully customize its vault as per its own design, allowing users to pick a vault based on the features that best suit the depositor. Essentially, Vaults are completely agnostic to the staking solutions that an operator wants to run - whatever client solutions, KYC features, MEV relays or DVT middleware that the entity wants to run are under their control. This leads to a very diverse marketplace of staking solutions that users can shop around and choose from.

Moreover, Vault Operators can set their Vault to a private setting, allowing deposits only from addresses whitelisted by the Vault Operator. This enables use cases like solo stakers depositing ETH into their own Vault and not accepting deposits from others. For instance, compliance-sensitive organizations can create a Vault to enable staking for only a limited number of KYC'd participants.

Layer 2: The osETH Token

The osETH Token is a new type of overcollateralised ETH token introduced by V3, which is a liquid ERC-20 representation of staked assets that uses Vault Token(s) as collateral. It can be minted by anyone who has staked ETH into a Vault(s), or can be bought/sold on decentralized exchanges.

Importantly, osETH represents a new type of liquid-staked ETH token that has its value pegged to staked ETH 1:1, but that does not directly pass on the slashing losses to holders, ensuring that all the staking rewards and penalties remain isolated to the individual Vault. To ensure this, V3 requires >1 ETH for every osETH that stakers in Vault want to mint. In the scenario where slashing does occur, there is always a reserve of ETH that absorbs the slashing losses before osETH holders are affected. This protects osETH holders from losing their principal, making osETH a safer option for staking.

Note that the stakers who mint osETH are still exposed to the slashing risk of the Vaults in which they staked ETH, and excess collateralization makes sure that the other osETH holders are not affected.

For solo stakers -

StakeWise V3 empowers solo stakers by allowing them to mint osETH tokens against their nodes, providing access to DeFi opportunities while maintaining a non-custodial setup. Solo stakers can set up private vaults, mint osETH, and even earn additional revenue by hosting validators for other stakers. Alternatively, public vaults enable solo stakers to accept delegations, maximize their score, and mint osETH based on received vault tokens.

For DeFi users -

StakeWise V3 caters to users seeking yields by providing osETH tokens, tradable in decentralized exchanges or minted within vaults. osETH integrates slashing protection, and ensures that staked capital are not co-mingled across funds, thereby offering a less-risky, diverse marketplace for users to mint osETH and use it in DeFi.

For institutions and exchanges -

Financial institutions typically prefer direct engagement with trusted staking service providers to ensure due diligence and favorable terms. StakeWise V3 caters to this preference by enabling institutions and exchanges to create private vaults, allowing exclusive collaboration with chosen operators and staking clients. Vault tokens from staking represent staked ETH, offering institutions the flexibility to enable liquidity and utility within their ecosystem. Additionally, for broader access to DeFi markets, institutions can mint or permit customers to mint osETH tokens.

For commercial node operators -

In StakeWise V3, operators, whether independent or collaborating with other entities, can establish vaults to accept delegations, allowing depositors to tokenize their staked ETH into osETH. Operators can choose to keep vaults private or public, showcase strong performance, and enhance their vault Score by taking risk-reducing measures.

As experienced node operators, we have established both our public pool (Chorus One - MEV Max) in StakeWise V3, providing individuals access to liquid staking while benefiting from our network expertise and proven MEV strategies. Our institutional clients also have the option of launching private, ring-fenced pools operated by Chorus One. For more details, refer to the final section of this article.

Chorus One is expanding the possibilities of V3’s Vaults by extending our MEV optimization strategies beyond a select group of customers to encompass ALL ETH stakers. We hold decentralization as a core value, and through our partnership with Stakewise, take immense pride in making our enterprise staking infrastructure to everyone - all without any minimum requirements to stake ETH.

Below, we provide a brief breakdown of the various methods available for staking ETH and minting osETH with Chorus One. For a comprehensive understanding of the benefits associated with staking your ETH on Chorus One's liquid staking pools, we've covered all the details here. Check it out!

Chorus One's public vault invites users to stake any amount of ETH and mint osETH, enjoying the benefits of our enterprise-grade staking infrastructure, proven MEV strategies, world-class security measures, and network expertise. Access Chorus One’s Public Vault here.

We will also have private, tailor-made vaults for clients seeking individual, personalized agreements for their staked capital. With these private pools, user assets stay separate and are not commingled with other Vaults, thus offering the perks of liquid staking with enhanced security and all the other benefits Chorus One has to offer—higher MEV yields, top-notch security, network expertise, and more. To launch Private Vault with Chorus One, please reach out to us at staking@chorus.one.

In addition, we're making liquid staking more accessible to both our existing and new OPUS customers.

Soon, our public pool will be seamlessly integrated into our Staking Dashboard, allowing OPUS users to dive into liquid staking, mint osETH, and leverage it in DeFi or hold it—all with just a few clicks! Stay tuned for more updates coming your way soon!

You can also get a glimpse of how it will work, and more insights into Stakewise v3 from Jordan Sutcliffe’s speech at the staking summit, here.

About Chorus One

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 45+ Proof-of-Stake networks including Ethereum, Cosmos, Solana, Avalanche, and Near amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.

In March 2020, Vitalik Buterin expressed frustration over the lack of a trustless solution for swapping between BTC and ETH. Fast forward to November 2023, and Chainflip has finally arrived, transforming swaps with a straightforward and seamless process for exchanging digital assets. Chorus One is proud to support the network as one of the genesis validators!

Chainflip is a cross-chain decentralized exchange based on a proof-of-stake validator network that offers users the simplest way to swap assets across different chains. Fully permissionless, it simplifies trading for users who can select the coins they want to trade and submit the transaction. No wrapped tokens, synthetic assets, KYC, P2P counterparties, or any other time-consuming complexities are requisite. Chainflip is designed to minimize slippage and offer great pricing for high-liquidity trading pairs.

Contrary to traditional AMMs like Uniswap, where liquidity is maintained through smart contract-stored pools, Chainflip operates with up to 150 validators constructing multisig 'vaults' on all supported blockchains simultaneously, collateralised by Chainflip's token, FLIP. The assets used for trading are held in these Vaults on chains such as Ethereum, Bitcoin, and so on, creating a decentralized ‘settlement layer’. This is paired with the ‘accounting layer’, the Chainflip State Chain, which is a substrate-based application specific Blockchain. Instead of traditional on-chain pools, Chainflip virtually trades assets on the ‘State Chain’, balancing accounts and settling with the real assets stored securely in Vaults. The State Chain oversees all activities in the Chainflip protocol, including but not limited to recording, executing, or triggering protocol events. Think of it like a unified wallet system in centralized exchanges, simplifying the tracking of user balances.

Trading and tracking assets virtually on the State Chain simplifies the work needed to support individual chains, as rather than needing to write swapping logic in a range of smart contract and scripting languages on external blockchains, it is entirely contained within the Chainflip State Chain environment.

Validators achieve consensus on every transaction within the Chainflip State Chain. FLIP is automatically purchased and burned with each swap, funding emissions for validators and offering liquidity incentives.

Additionally, all of the swapping and trading logic happens on the State Chain, meaning it’s fast, cheap, and dedicated for this purpose. The user experience is incredibly simple, requiring only a destination address for a swap, without any setup: The user selects the coins they want to buy/sell and submit the transaction. No wrapped tokens, synthetic assets, KYC, P2P counterparties, or anything else complex and time consuming is needed.

The above animation by Chainflip demonstrates the path of a typical swap, where a hypothetical user swaps USDC (ERC20) for BTC (native), and Market Makers A & B compete to win the liquidity fee from the trade. Source: https://docs.chainflip.io

For a more detailed explanation of each step, visit https://docs.chainflip.io/concepts/swaps-amm/just-in-time-amm-protocol

Chainflip, a Proof of Stake network without support for native delegation, allows up to 150 validators in the protocol's authority set. Validators secure the network using collateralized FLIP as part of the active set. All Validators with sufficient $FLIP to outbid others in Auctions become part of the active set and similar to Ethereum, each authority member earns equal rewards per epoch. A fixed reward (much less than the Authority Set reward) is split between Backup Validators each Epoch. To be a Backup Validator, Validators must be Qualified and have one of the top 50 bids of non-Authorities.

We've collaborated closely with Chainflip since its inception, actively participating in the testnet.

While users can't delegate FLIP to public nodes, our institutional customers can get involved through Chorus One's whitelabel solution for Chainflip. We set up and maintain validator nodes on your behalf, allowing you to brand the node while we handle all the technicalities. To learn more about our whitelabel solution for FLIP, please reach out to us at staking@chorus.one.

Conversation with Simon Harman, founder of Chainflip on Epicenter Podcast -

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 45+ Proof-of-Stake networks including Ethereum, Cosmos, Solana, Avalanche, and Near amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.

We’re immensely proud to support staking for Celestia - the first modular blockchain network that is optimized for ordering transaction data and making it available- as a genesis validator!

Celestia is a modular network that makes it easy for builders to launch their own blockchain by focusing solely on data availability. It allows developers to easily deploy blockchains on top of Celestia, much like deploying smart contracts. This accessibility empowers individuals to create their own unique rollups and blockchains, serving a multitude of purposes and ensuring scalability for a broader audience.

Celestia's data availability layer introduces innovative features like data availability sampling (DAS) and Namespaced Merkle trees (NMTs). DAS allows light nodes to verify data without downloading entire blocks, reducing costs compared to monolithic chains, while NMTs enable execution and settlement layers on Celestia to download transactions that are only relevant to them. Celestia offers its data availability layer to other chains for publishing data by paying for blobspace.

We've covered everything you need to know about Celestia in 10 questions - find it here!

As a permissionless network, Celestia uses Proof-of-Stake to secure its own chain. Like any other Cosmos network, users can help secure the network and engage in governance by delegating their TIA to a validator like Chorus One.

The following guide explains how you can stake your TIA easily with Chorus One.

TL;DR

Step 1: Login to https://wallet.keplr.app/ and search for Celestia

Step 2: Select the Chorus One validator

Step 3: Enter the amount of TIA you want to stake

Step 4: Approve the transaction. You have successfully staked TIA with Chorus One!

*Note that this guide has been written using the Celestia Mocha Testnet as it was written prior to Mainnet, however the steps remain the same.

After a few seconds, the transaction will be completed. You have now successfully staked TIA with Chorus One using Keplr!

If you have any support queries, please send a request at https://support.chorus.one/hc/en-us. If you would like to learn more about Celestia or start staking TIA with Chorus One, please reach out to us at staking@chorus.one

About Chorus One

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 45+ Proof-of-Stake networks including Ethereum, Cosmos, Solana, Avalanche, and Near amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.

The latest and fourth iteration of dYdX, the dYdX Chain is officially live! This new version, built using the Cosmos SDK is the latest addition to the bolstering Cosmos ecosystem and marks a momentous event in the future of DeFi. Chorus One is immensely proud to be a genesis validator for dYdX v4, overseeing the unique off-chain, in-memory order book trading system within the network.

Since 2017, dYdX has emerged as a leading cryptocurrency trading platform. It has facilitated the trading of over $1 trillion in assets via Ethereum's smart contracts. With dYdX v4, the platform has transitioned into a standalone chain within the Cosmos ecosystem. By embracing the Cosmos SDK, dYdX gains the advantages of enhanced decentralization, scalability, and unrivaled customizability.

In 2017, dYdX ventured as an Ethereum Layer 1 application. However, it faced challenges, particularly concerning scalability and high gas fees. In response, they shifted to an Ethereum-based Layer 2 solution, a move that successfully alleviated the fee issue but introduced elements of centralization.

Now, with v4, dYdX introduces a fully open-sourced, off-chain order book primed for seamless scalability. By aligning with the Cosmos ecosystem, dYdX positions itself to harness the full spectrum of decentralization, customizability, and scalability.

Our comprehensive explainer covers all things dYdX, including an in-depth look at their transition to Cosmos and Chorus One's continuous engagement with dYdX since its inception. Check it out, here.

The dYdX v4 token, DYDX, serves a variety of purposes. Most significantly, users can not only participate in governance proposals but also contribute to the network's overall operation and security by staking their dYdX v4 tokens and earning rewards for their work.

However, to use and stake dYdX v4 tokens, the dYdX Chain needs to onboard users from various platforms, including rollups, Ethereum L1, other app-chains, and centralized exchanges, to its Cosmos version.

To simplify this, we have developed a unique bridging solution which lets you swiftly move your DYDX tokens from Ethereum to Cosmos, and even stake them simultaneously in the same transaction. To bridge your DYDX from Ethereum to Cosmos, check out our detailed guide here.

Alternatively, if you already have DYDX tokens in the Cosmos ecosystem, you can directly stake them with Chorus One using your Keplr wallet, as explained here.

*Since DYDX inflation goes to traders, dYdX stakers, in contrast, will receive 100% of the trading fees that are paid out in USDC.

To learn more about how you can get started with staking DYDX with Chorus One, don’t hesitate to reach out to us at staking@chorus.one.

About Chorus One

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 45+ Proof-of-Stake networks including Ethereum, Cosmos, Solana, Avalanche, and Near amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.

We are excited to announce our partnership as Mainnet Alpha operators with Obol Network!

In April of this year, the Obol Network achieved a significant milestone with the launch of its Alpha phase, which witnessed the deployment of the first Mainnet Distributed Validators (DV) by the staking community. The foundation for this initiative was laid by the core team in December 2022 when they deployed the very first Mainnet DV. Since then, more than 45 organizations have joined in, running Distributed Validators on the Ethereum Mainnet in either solo or multi-org clusters.

In a nutshell, Obol Network is an ecosystem designed for trust-minimized staking, enabling anyone to create, test, operate, and coordinate distributed validators, with a primary focus on Ethereum staking solutions.

Presently, there is no way to operate validators in a high-availability environment without introducing the risk of slashing. Each validator operates as a single entity with its private key, and the high barriers to entry for running validators can naturally lead to stake centralization within the ecosystem.

This is where Obol steps in.

The Obol Labs takes the lead in addressing these challenges, particularly working to address stake centralization by improving the scalability and resiliency of Ethereum consensus. Obol has developed Distributed Validator Technology (DVT) to enable multiple nodes to function collectively as a single validator on Ethereum. Through Obol’s distributed validator client, ‘Charon’, multiple nodes work together by combining their partial signatures into a full signature for the distributed validator and coming to consensus.

DVT ensures fault tolerance as long as a specific threshold of active nodes is met (e.g., 3 out of 4, 5 out of 7, 7 out of 10, etc.). This approach enhances security, offers near-perfect performance, and eliminates the vulnerability of a single point of failure in validator nodes by distributing responsibilities across multiple nodes. Additionally, each node within a DV cluster can be run by different individuals or groups, thereby improving byzantine fault tolerance. As a result, DVs strengthen resilience while reducing security risks. In addition, this approach also reduces the risk of stake centralization by lowering entry barriers, enabling a broader participation in running validators effectively.

As we approach the full Ethereum mainnet deployment of Obol, Chorus One, alongside other players, have launched an Obol DV on Mainnet in their Alpha Phase. We are also continuing to test DVs on the Görli testnet to ensure support for varying node counts and the expansion of clusters to accommodate a growing number of validators. Within this comprehensive evaluation, we are closely examining crucial metrics such as the efficiency of validator duties, occurrences of missed duties, and inclusion distances, among other vital aspects, including the potential impact of MEV-boost on these configurations.

Our shared dedication to gathering this essential data is geared towards empowering stakeholders to confidently deploy distributed validators on the Ethereum mainnet. Furthermore, through our collaborative efforts, we aim to cultivate a deeper appreciation for the significance of DVT within the broader ecosystem. Together, we are committed to spearheading the adoption of decentralized staking, propelling Ethereum staking to new heights and ensuring it's more efficient, secure, and scalable than ever before.

About Chorus One

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 40+ Proof-of-Stake networks including Ethereum, Cosmos, Solana, Avalanche, and Near amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.

When it comes to staking ETH, a recurring challenge arises - the requirement to sign multiple transitions for substantial deposits. This complexity has been especially a persistent hurdle in the path of institutional stakers. To combat this, we’ve devised a solution that streamlines institutional staking: the ability to seamlessly stake 8000ETH , or 250 validators in a SINGLE transaction.

The conventional process of staking entails a series of transactions, which becomes increasingly cumbersome as the amount of stake grows. Institutions have long sought a more straightforward method for engaging in staking without the complexity of multiple signatures. Enter our new feature, which enables institutions and investors to stake up to 8000 ETH in a single, seamless transaction. This approach transforms staking on OPUS, Chorus One's multi-chain staking solution that caters to both institutions and individual investors, into a simple one-click process, streamlining the experience and reducing staking limits.

In the upcoming months, we aim to further enhance this capability, allowing customers to stake more in a single transaction than what the industry typically offers.

In addition to this streamlined process, complemented by OPUS's user-friendly staking interface, staking through Chorus One's OPUS offers a range of distinct advantages:

Staking ETH on OPUS is made easy through two methods:

Here's a brief demo to guide you through the process of staking with OPUS:

To learn more, or get started with staking with Chorus One, reach out to us at staking@chorus.one.

About Chorus One

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 45+ Proof-of-Stake networks including Ethereum, Cosmos, Solana, Avalanche, and Near amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.

We are excited to announce a significant milestone in our collaboration with BitGo, a prominent regulated custody, financial services, and core infrastructure provider. BitGo has partnered with Chorus One to expand staking for a diverse range of networks, including Sui, Sei, Injective, Osmosis, and Agoric. This collaboration underscores our longstanding relationship, spanning over a year, and solidifies our position as a preferred staking provider for institutions seeking security, compliance, and cutting-edge research.

BitGo's decision to collaborate with Chorus One as their staking provider is rooted in several key factors that set us apart:

Security, Compliance, and Regulatory Expertise

Swiss Heritage: Switzerland’s robust regulatory framework for digital assets makes it a prime choice for industry players. Chorus One's Swiss origins reflect our commitment to rigorous standards and regulatory compliance—a critical factor for BitGo.

Comprehensive Compliance Checks: BitGo places paramount importance on regulatory compliance, and we meticulously meet all necessary requirements. Our rigorous compliance checks ensure that our staking operations consistently adhere to the highest standards, instilling unwavering confidence in institutions that choose us as their staking provider.

Top-Notch Security: BitGo values security above all else, and Chorus One boasts an impeccable track record in safeguarding staked assets, ensuring the safety of BitGo's assets.

Network Expertise and Streamlined Onboarding

Effortless Onboarding: BitGo sought a provider with extensive knowledge of a wide array of networks, along with the capability to swiftly enter validator sets. Our concise onboarding framework allows BitGo to stake tokens across multiple networks seamlessly, quickly, and efficiently.

Cosmos Network Proficiency: BitGo's interest in Cosmos networks aligns with Chorus One's long-standing involvement and expertise in this ecosystem. Our extensive knowledge positions us as a go-to provider for BitGo in their Cosmos-related endeavors.

Research Excellence

Chorus One Research, our in-house research arm, is highly regarded in the industry for its in-depth analysis of crypto and staking trends. This research is deeply valued by institutional partners like BitGo. Through this collaboration, BitGo gains access to our comprehensive research resources, enhancing their knowledge base.

"Chorus One's extensive expertise in emerging and leading networks has streamlined staking and onboarding for us.. Their stringent regulatory and compliance standards, as well as their notable performance and track record also give us peace of mind for a long-term collaboration." -Thomas Chen, Managing Director, BitGo

"We hold security, compliance, and regulation in the highest regard, and prioritize partnering with organizations that share these values. As a trusted leader and one of the few qualified custodians in the industry, we take pride in partnering with BitGo. We eagerly anticipate the opportunity to deliver the highest caliber staking and custody services to our mutual customers." - Brian Fabian Crain, CEO, Chorus One

Chorus One's collaboration with BitGo reaffirms our commitment to serving the institutional market with unwavering dedication to security, compliance, research excellence, and exceptional customer support. We look forward to this collaboration as we continue to provide the highest level of service to institutions looking to expand their staking activities.

To begin staking with Chorus One or learn more about our offerings, please contact us at staking@chorus.one.

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 40+ Proof-of-Stake networks including Ethereum, Cosmos, Solana, Avalanche, and Near amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.